About this app

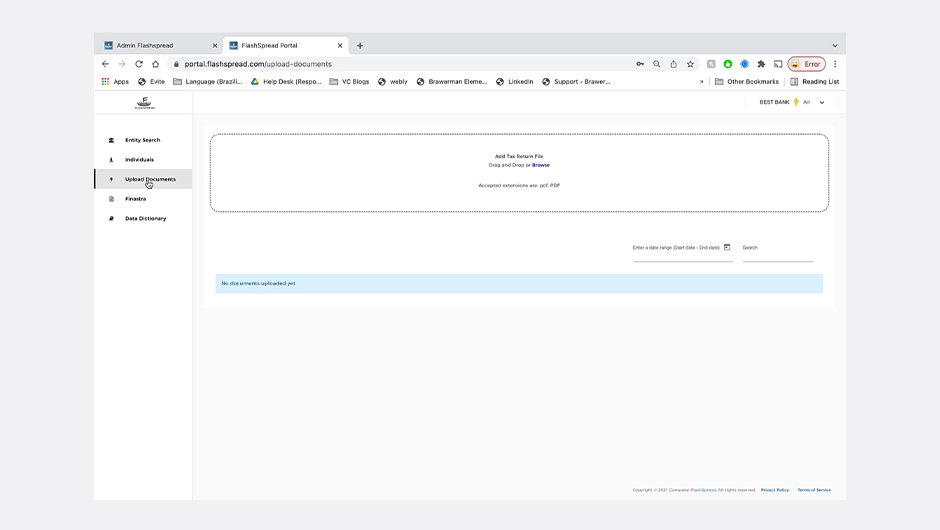

FlashSpread’s Spreading Tax Returns application instantly converts scanned or digital pdf tax returns into complex and comprehensive financial reports and analysis with little to no human interaction - from collection and extraction, verification and importing to the CreditQuest Financial Analyzer for spread calculation. This enables Banks and Credit Unions as lenders to make error free, data-driven, credit decisions for faster commercial loans application decisioning.

When making new deals or annual reviews of existing ones, credit officers need to ensure that all figures extracted from tax return are accurate, or risk providing wrong spread information. In addition, while the application process is highly manual (scanned documents, watermarks, etc…), the customer expects efficient processing, despite the poor quality of the documents they provide. Banks and Credit Unions need a reduced decisioning and annual review time to be competitive to win and retain customers, by automating their tax return spreading.

Speed and Accuracy

It takes hours to spread a deal, either because of a human based process or due to an OCR technology that turns out to be too limited on low quality paper scans. By using FlashSpread, you overcome this bottleneck and reduce the deal spreading time by 96%.

100% Data Confidence

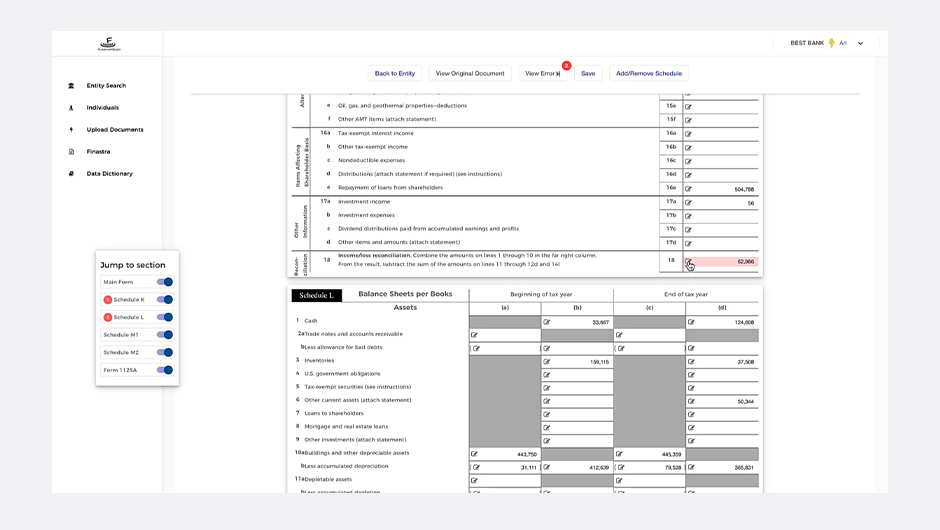

FlashSpread platform can identify incorrect values and manually adjust them. After the extraction and digitization of the information, only 18% of the overall number of tax returns require a manual intervention. Then, the easy validation tool allows to edit any values in the tax return and/or reports, while viewing the original file side-by-side, giving you 100% confidence in your data.

Full e2e automation for quick decisioning

Lenders are tasked with hours of manual entry of tax returns for new applications as well as for each of the loans in their portfolio annually, hindering responsiveness. Turnkey automation with CreditQuest: tax return collection, extraction, verification, figures integration and calculations resulting in reduced decisioning time for loan application - Reducing tax return data entry time by 96%, thus improving the overall loan decisioning process.

Building blocks

Party

Search and return records for entities (parties) in the loan origination system records

Financial Spreads - Commercial / Personal

Financial analysis to use for credit decision and review of financial performance. The current API is to support Commercial & Industrial (C&I) and Personal chart of accounts