Open Banking Compliance Solution

A cost-effective and technically scalable approach to compliance, a SaaS solution with all banking requirements covered.

About this app

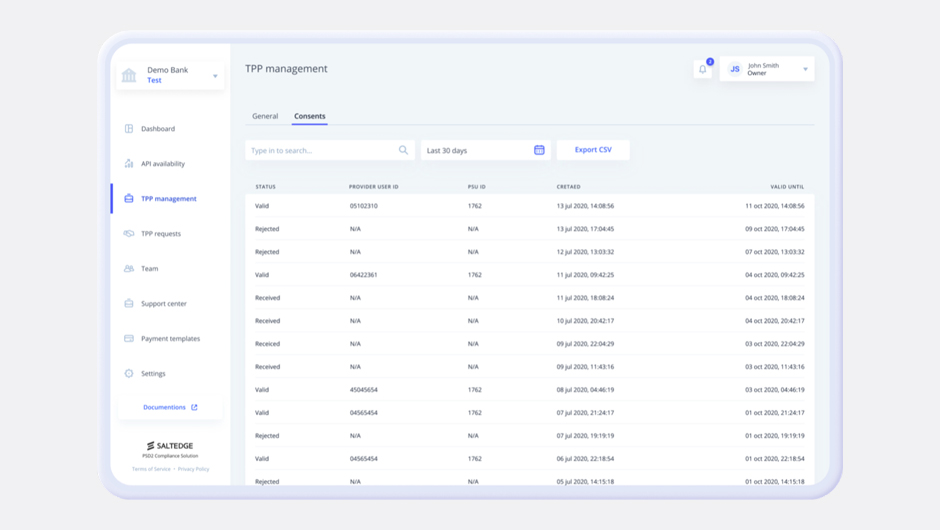

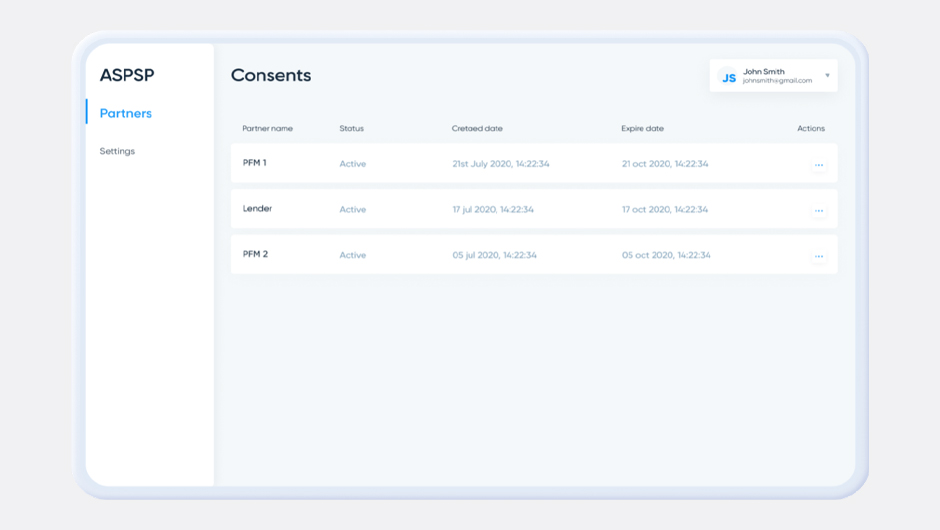

Salt Edge provides an Open Banking and PSD2 Compliance (Europe, UK, Australia, Brazil) solution covering all essential components required by regulators: Testing and Live environment for the TPPs for Account Information API & Payment Initiation API, the TPP Developer Portal, the TPP Management & Verification API, Consent Management SDK for banks web interface, a fallback channel and/or exemption from it. Additionally, we provide mobile-first application to comply with SCA and Dynamic Linking requirements.

Open Banking regulatory requirements are complex, and their implementation requires specific expertise that is not available in majority of banks. Development and maintenance are costly and developing the PSD2 APIs in-house can take up to 1 year – but regulators pressurize the Financial Institutions to meet deadlines.

Minimal Resources

Spare the cost of development, maintenance, and support. With Open Banking Compliance Solution, the client has minimal involvement in the technical implementation.

Be compliant with PSD2/OB requirements in 1 month

Pre-integration with Fusion Essence and Equation using APIs on FusionFabric.cloud allows clients to go live in one month.

Proven off-shelf solution

Salt Edge’s OB Compliance solution has a proven track record of success with more than 100+ API implementations for financial institutions globally. All TPP verification, communication, developer portal, API versioning and alignment with regulatory requirements are done by the vendor. SE PSD2 Solution was audited by third parties.

Building blocks

Financial Transactions

Enable financial transactions posting, reversal posting and enquiry on Finastra Core banking solutions

Customer Onboarding

Create new personal and enterprise customer profile, retrieve, update and search customer information and data deduplication.