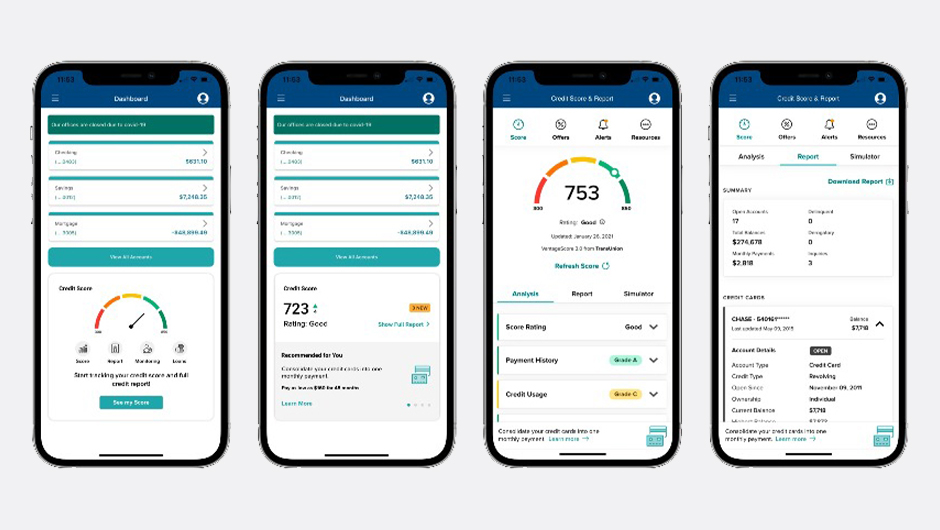

Credit Score and Report

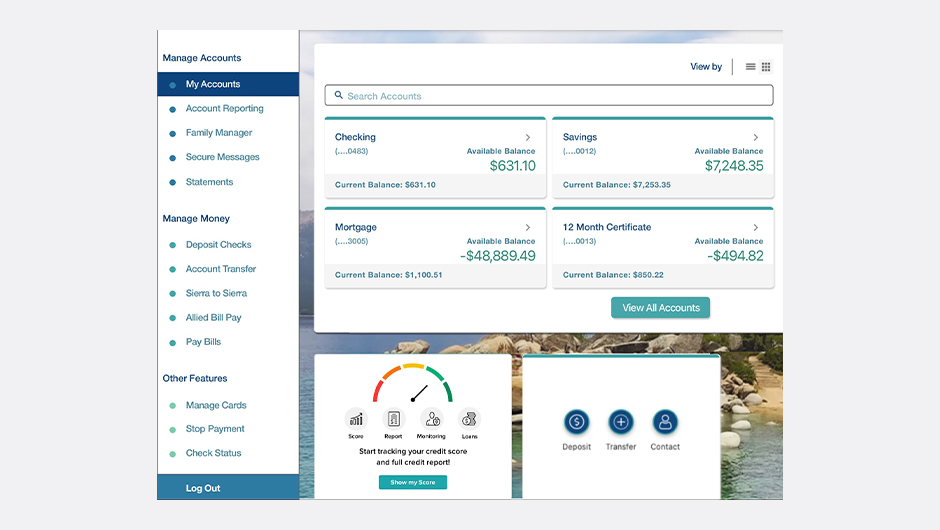

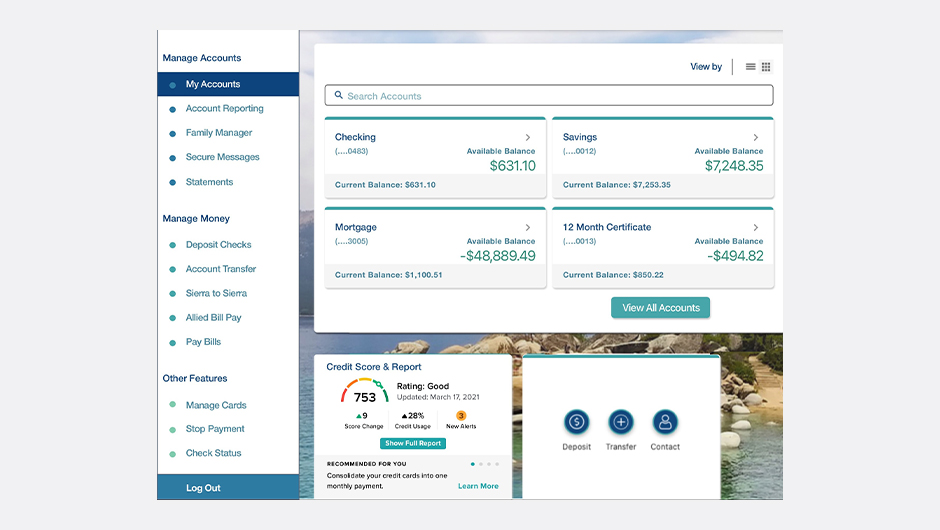

An integrated credit report and score solution right in your financial institution’s online and mobile banking.

About this app

SavvyMoney provides end-users with the ability to view their credit scores and educate themselves on aspects of their finances that affect these scores. Financial Institutions can offer products to their users based on their credit scores and insights into competing products. Through the credit score and report tool, the user not only sees their score, but gets guidance in understanding the factors affecting their scores and full credit report. Users are also able to engage with a credit score simulator to see what impact certain actions may have on their score.

Tracking financial health is always crucial, but especially in today’s environment. Customers want financial education from their financial institution, but many times banks and credit unions have no program or process to offer this support. Financial Wellness tools at larger institutions have become table stakes. Offering a robust solution through a smaller financial institution requires a Fintech partnership: financial institutions are unable to offer and deliver broad prevention tools like credit monitoring and identity theft prevention on their own.

Financial Education

Financial Institutions’ mission frequently include a message about supporting their customers financial wellness, yet many don’t have any programs in place to support this vision. The Credit Score and Report tool offers a solution, but also an opportunity for end-users to take control of their credit score. With personalized tips and prequalified loan offers and alerts to change or fraudulent activity, Savvy Money’s application is addressed to the 78% of customers that declared they were interested in receiving financial advice or guidance from their FI.

Analytics

Savvy Money's analytics platform benefits Financial Institutions by driving engagement, identifying loan opportunities for users based on their credit profile and the financial institution’s lending criteria - this means less time spent identifying leads and allows for time helping users find savings and providing valuable data and analytics via wallet share, activity in the tool, and targeted marketing campaign opportunities.

Seamless Integration

The integration requires minimal work for the financial institution: sending branding elements and testing is less than 8 hours of work, and kick-off to launch is 90 days max. The solution is co-branded with the financial institutions' logo, colors and offers, fitting perfectly into online and mobile banking for optimal user engagement and experience.