CloudMargin

The world’s first automated, single-instance, cloud-native collateral management platform that never stops evolving.

About this app

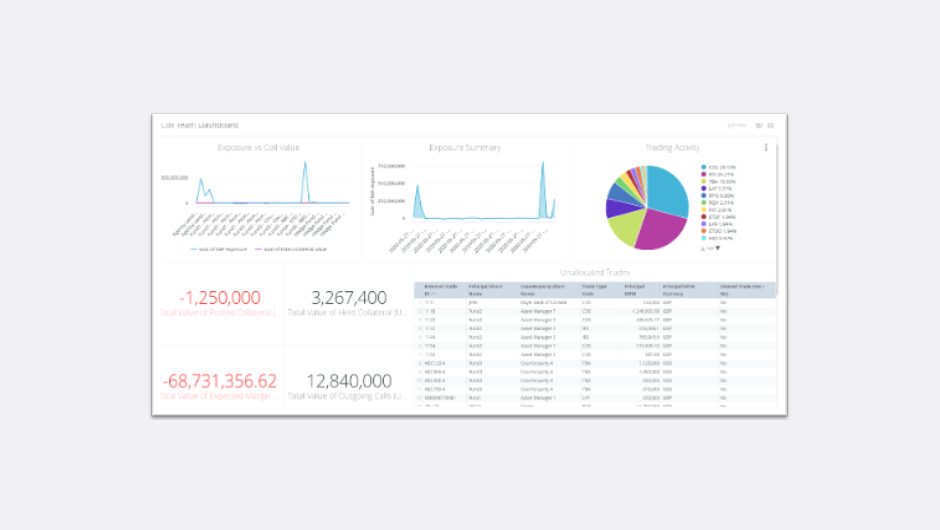

CloudMargin is owned by key market stakeholders including key infrastructure providers and dealer banks. It provides an end-to-end collateral management solution covering Variations and Initial Margin workflows, CSA, GMRA and GMSLA agreements, Bilateral and Triparty, Cleared and Uncleared transactions. All of this supported by a flexible reporting and scalable cloud-native technology.

There are multiple challenges to tackle in collateral management – the complex and everchanging context impacts the industry: such as increased regulatory/collateral obligations, squeezed margins and decreased appetite for risk. Meanwhile, standard market practice only compounds the challenge: inefficient use of collateral, inadequate client connectivity and low process automation.

Integration and Functionality

CloudMargin offers the capacity to deal with increased volume of trades and/or margin calls. The model is scalable, so the client pays only for what it needs. In addition, the solution is fully integrated with core systems (Kondor, Opics, Summit) which decreases the time-to-market.

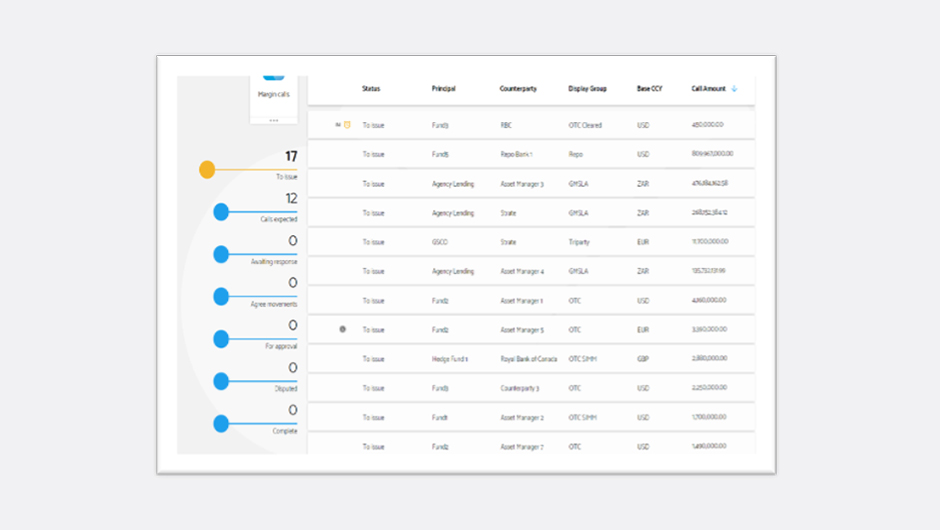

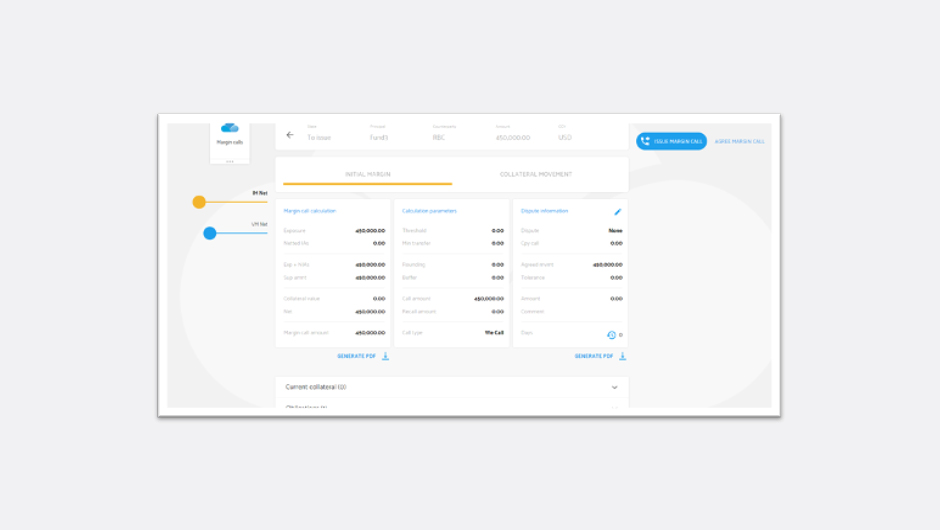

Operations and Disputes

Adopt a digitized end-to-end margin calls workflow and dispute management with counterparties leveraging industry standard AcadiaSoft MarginManager. Set tolerance levels and optimization rules so you increase the STP rate and manually intervene only to handle exceptions.

Implementation and Maintenance

As current solutions require long and costly upgrades and a specific technical team, CloudMargin increases agility with a Turn-key cloud-based solution implementable in few weeks and providing continuous updates.

Building blocks

Collateral Agreement Eligible Trades Data

Access collateral agreement eligible trades details and their respective valuations for collateral management purposes