Trading Book Market & Credit Risk Solution

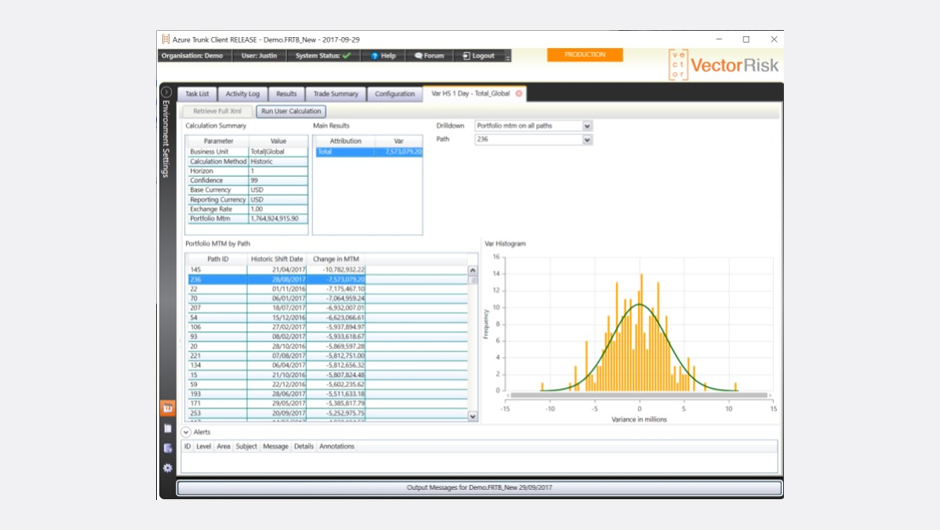

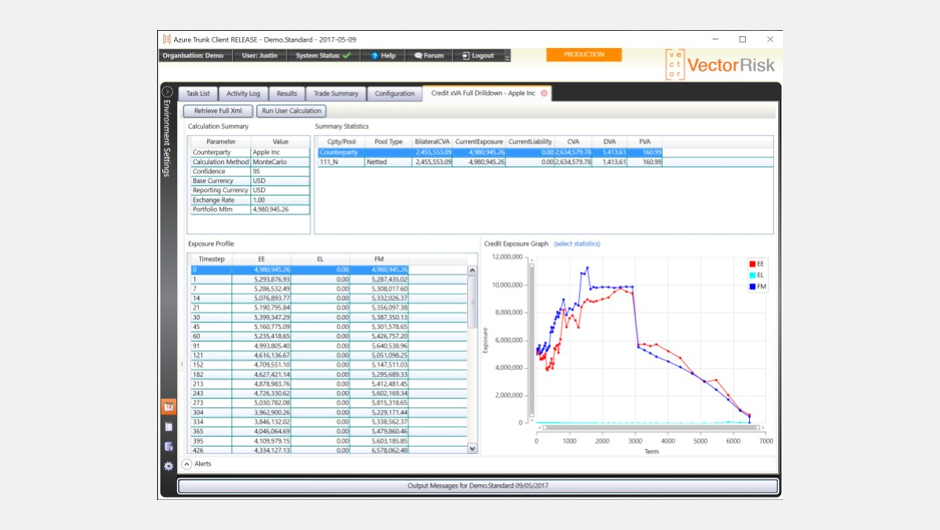

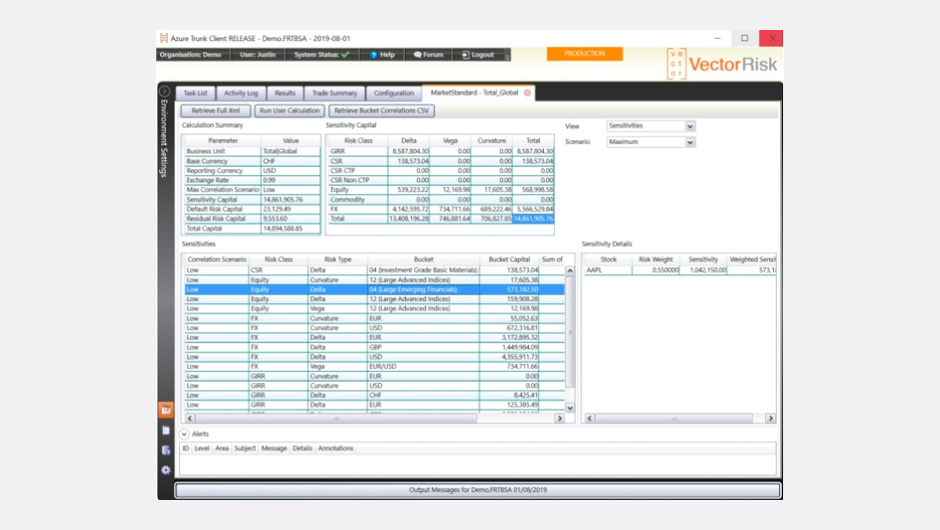

Full end of day and real time solution for market and credit risk, including VaR, PFE, xVA and complete FRTB.

About this app

Vector Risk provides a true multi-tenancy SaaS solution for VaR, PFE, xVA and FRTB (SA & IMA). Hosted on Microsoft Azure, it uses Microsoft HPC (high performance computing) for extreme computational performance, for example carrying out 32 billion trades valuations in 22 minutes.

Running risk systems on-prem is a costly exercise (license, hardware, maintenance, administration etc.). Simplicity, agility and efficiency are the new standard in order to overcome cost pressure, audit pressure and to successfully keep up with everchanging regulations. As a SaaS solution, Vector Risk dramatically reduces implementation timeframes, has little project risk, requires no new IT infrastructure, and provides regulatory evergreening. Extreme performance enables you to carry out portfolio IMA in minutes rather than hours. Vector Risk offers a complete FRTB solution with software that's in production.

Risk as a Service

Azure hosted, true multi-tenancy SaaS solution to overcome the traditional and costly on-prem approaches by delivering a subscription-type suite that cuts initial costs, its easy and quick to deploy and eliminates workload and responsibility for the client.

Integrated Trades & Rates

Trade and Rate data from the Finastra trading platform can be automatically loaded into the app using Azure Data Share.

Risk Analytics

The app’s suite of analytics includes FRTB SA & IMA. Vector Risk constantly updates the solution to enhance performance, add new pricing functions and to keep pace with regulatory standards (“regulatory evergreening”) – all this included in the subscription.

Building blocks

Trades Financial Data

Retrieve financial and contractual information of trades, including parties involved, deal type, terms and conditions, with transaction price and the associated market data from the position keeping system

Trades and Positions Data

Get detailed information regarding trades, including historical trends, parties involved, deal type, terms, and transaction price and the associated market data