Straterix Scenarios

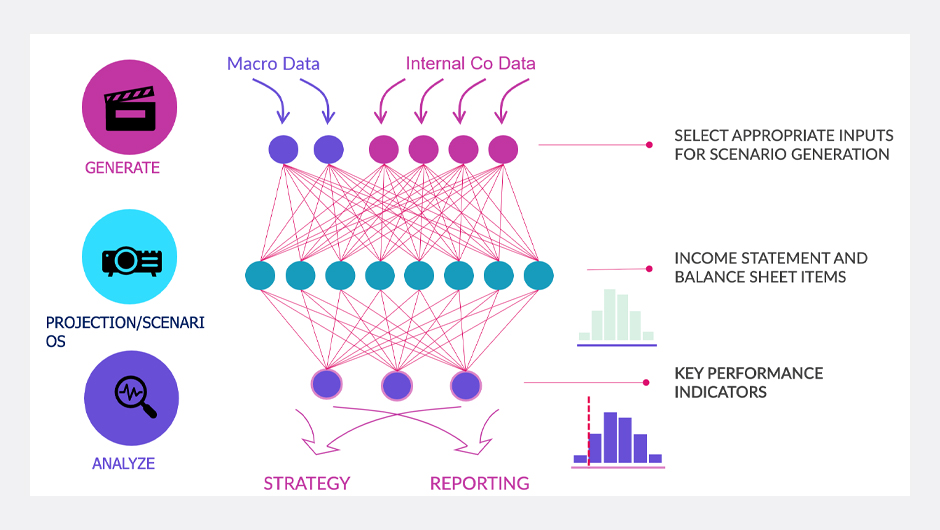

ML-powered SaaS solution automating scenario generation, stress testing, expected credit losses and BS / IS projection

About this app

Machine-Learning (ML) powered SaaS solution that automatically generates stress and CECL / IFRS 9 scenarios, projects balance sheet and income statement items on scenarios. The system supplies all necessary data to Fusion Optimum for results rendering and report generation.

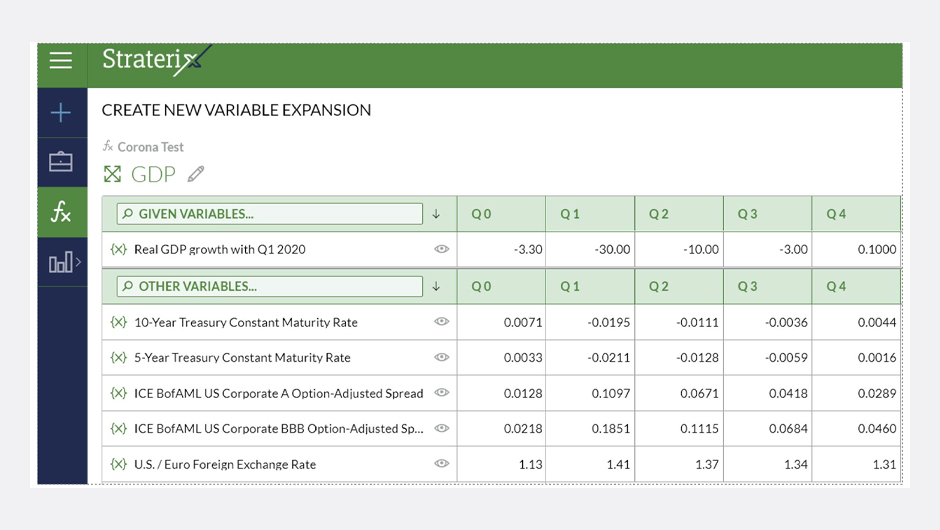

Regulatory requirements such as CCAR, other stress tests, CECL, IFRS 9 force banks to incorporate macro-economic scenarios in business planning and post-COVID contingency planning. On top of that, Financial Institutions face questions from auditors considering the extreme events we have recently endured.

Flexible

Top down, organization wide view is possible – scope is up to the clients to determine, and there is the possibility for them to use their own models (along with our scenarios). The scenario expansion is automated (from Given Variables) and Support of PPNR (pre-provision net revenue) Calculation

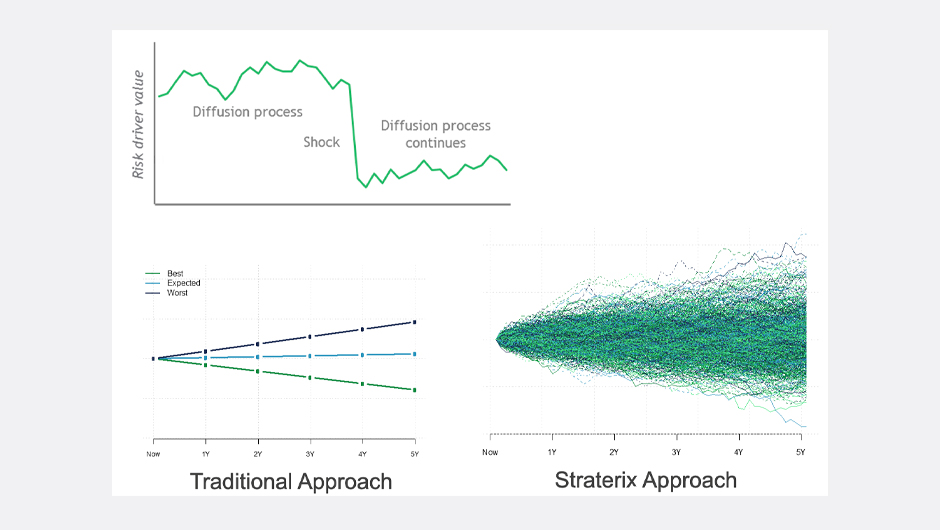

Accurately assess risks

By considering both stable and stressed market conditions, projection of extreme scenarios with probability of such scenarios occurring and inclusion of Macroeconomic variables

Easy and intuitive User Interface

The application allows for rapid adoption in the client organization.

Building blocks

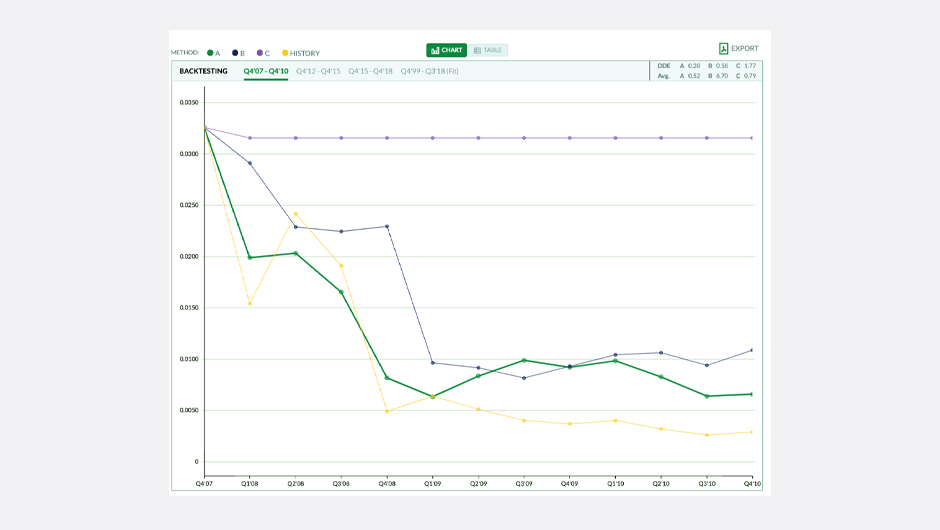

Risk Scenarios

Import externally generated market and credit scenarios allowing banks and financial institutions to account for credit risk in Asset & Liability management and optimize credit loss provisions