XVA Summit Add-In

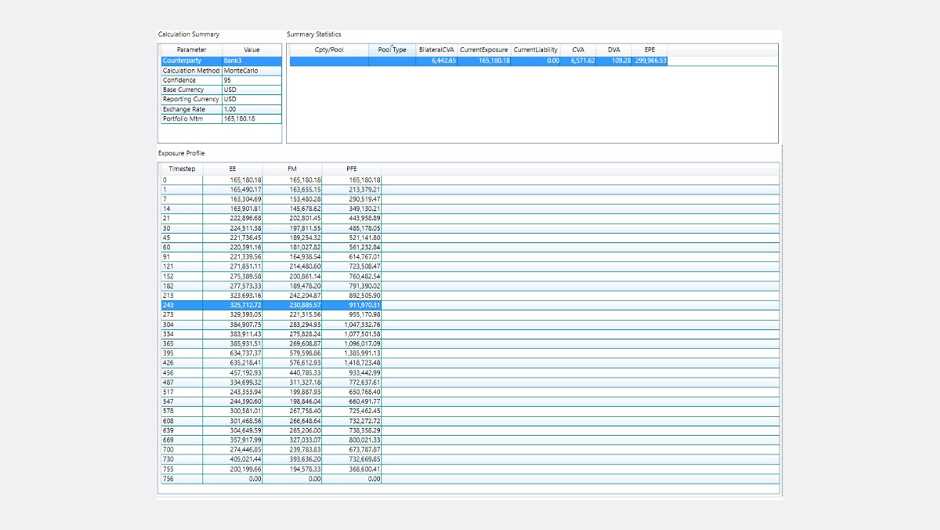

The XVA App uses SPI to connect with Summit to deliver pre-deal XVA. Metrics include CVA, Bilateral CVA, DVA & FVA.

About this app

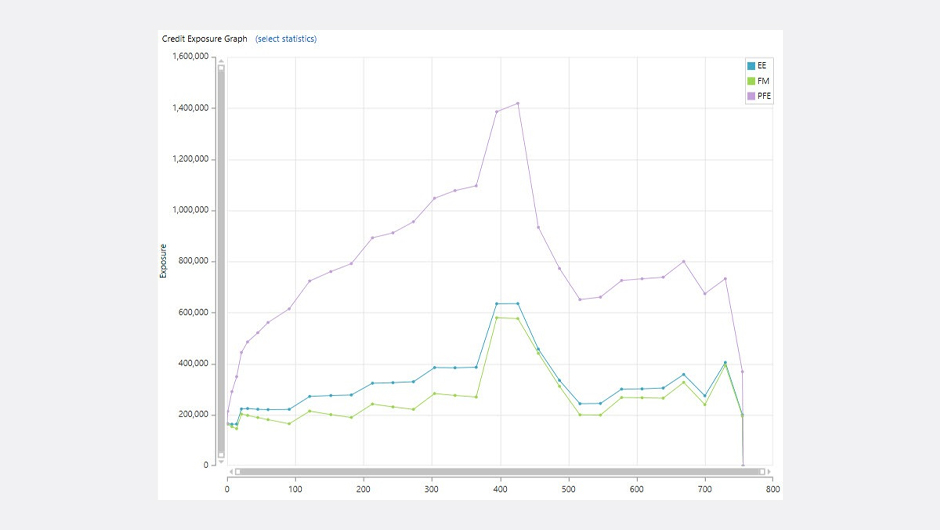

The cloud-based risk analytics service provides industry standard portfolio XVA calculations, correctly taking into account netting/economic offset legal agreements, collateral and margining, within a full Monte Carlo framework, across all major asset classes and product types.

Key benefits include:

- Risk neutral evolution for risk factors where implied volatilities are available

- Correlated default (wrong way risk) modelling

- Dynamical (path-dependent) collateral (CSA) and margining agreement handling

- Automated switchover to OIS-flavoured single and cross-currency zero curves for margined or CSA managed trades/pools

- Correct path handling within the MC framework for trades with triggers, barriers, fixings, etc.

- Detailed drilldown allows the user to investigate evolved rates and trade valuations to analyse unexpected results and to provide regulatory transparency

The cloud-based risk analytics are based on industry leading vector code. All aspects of the simulation are vectorized to achieve unrivalled performance. Cloud delivery means that cost of ownership is reduced even further: the clients get the power they need, when they need it, at a fraction of the price that they would have to pay for internal deployments.

Building blocks

Portfolio Analytics

Enable pre-trade and end-of-day PFE/XVA analytics service (credit, debit, margin, funding and capital costs, counterparty risk, credit risk)