A new world of end-to-end Lending

Optimize your channels

Unlock more omnichannel capabilities, enhance profitability across every point-of-sale channel where business is captured and apply for multiple accounts in one go

Accelerate onboarding

Convert prospects faster with our unified, highly configurable self-service application, and increase customer satisfaction through our easy-to-use, customizable platform

Automate processes

Reduce errors and turnaround time through modernized and cloud-based architecture

A complete origination experience

Helping you to deliver a connected experience that bridges the gap between application and origination.

Bring new business onboard faster

Your all-in-one partner, Finastra Originate enables powerful personalization through our regulatory-compliant platform for mortgages, business, and consumer loans, and deposit accounts. Empower your customers with a robust, easy-to-use self-service experience to meet their financial goals with real-time decisioning and immediate access to accounts and loans when it matters most to them.

Master compliance

Leverage Finastra’s "compliance-first" design strategy to better identify and mitigate risk in your lending operations

Boost productivity & efficiency

With automated workflows, staff collaboration and reduction in rekeying of data

Improve customer experience

Drive customer engagement with reduced loan and deposit decision turn-time

Powerful features for all origination types

Finastra Originate is tailored to your financial institution’s specific needs. It is highly configurable, cloud-based, and is white-labeled to match your own branding. The platform is designed to cover the entire loan origination spectrum, including mortgages, loans, and deposits for both consumers and businesses.

- Maximize every opportunity and make loans officers more productive

- A streamlined and modern end-to-end customer process

- Automated financial institution workflows in a cloud-based environment

- Supports compliance with Section 1071 of the Dodd-Frank Act

Our Originate solutions: Where an exceptional customer experience, compliance, and increased revenue can be achieved with one partner

Provide customers with a best-in-class personalized self-service experience for all mortgage products. Deliver swift turnaround times, instant offers, approvals, and automated 3-day disclosures. Streamline lending operations with our cloud-hosted solution to create raving fans, enforce compliance, boost application volumes, and close loans faster.

Originate Consumer for Loans and Deposits

Get instant approvals and immediate online disclosures easier than ever! Our single cloud-based portal ensures multi-channel capabilities for applicants across all consumer account and loan types. Applicants are guided every step and can complete the form within 5 minutes and enjoy a seamless and efficiency customer experience.

Originate Business for Loans and Deposits

Submit loan applications and open deposit accounts simultaneously! Our one-stop-shop turns prospects into account holders and is cloud-deployed for superior internal and external management. Applicants can complete a form or create an account in under 5 minutes, get instant approvals, and receive online disclosures.

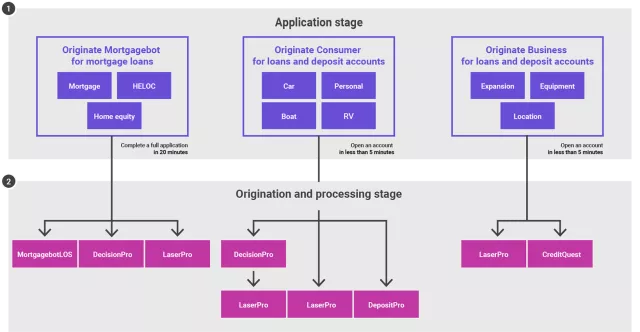

Originate one-stop shop workflow

Originate simplifies and streamlines the account application process and features powerful integration to Finastra and select third-party LOS solutions, each of which integrates with LaserPro, Finastra’s state-of-art compliant loan document engine.

Solution Store from Finastra: Buying made easy

The Solution Store allows existing customers to browse Finastra’s online catalog of product solutions and make purchases with the ease of a few clicks:

- From Compliance Reporter to Data Insights to training, many of Finastra’s state-of-art services are at your fingertips with more being added regularly.

- Enjoy a seamless, efficient experience - when and where it’s convenient.

- Securely purchase services in mere minutes.

From draft to done: Seamless external collaboration with LaserPro Conductor Guest.

Give your account holders and borrowers a great user experience