Scalable origination solution that grows with your business

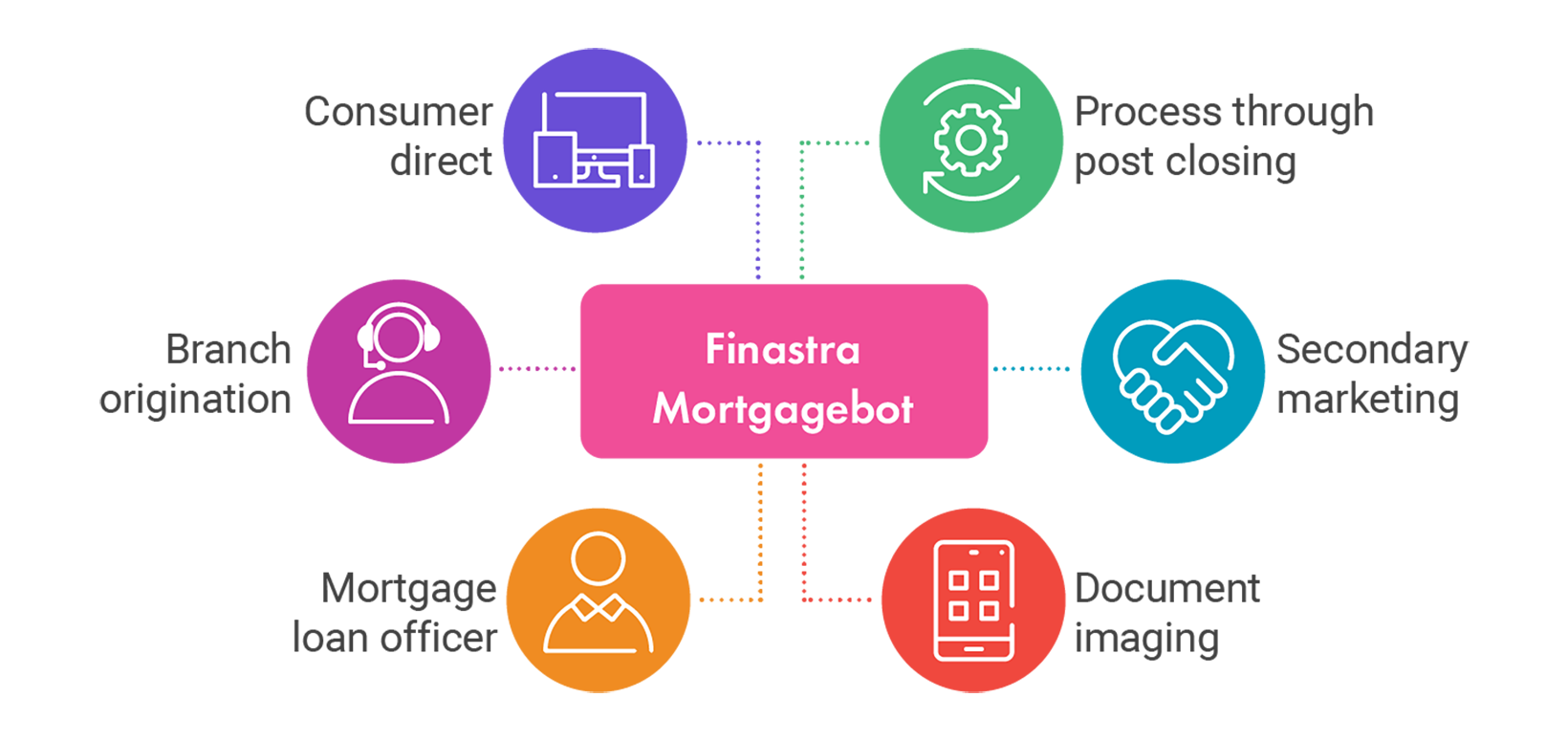

All‑in‑one, secure, cloud‑native loan origination system designed for retail, wholesale, and correspondent mortgage lending. As the industry’s only fully digital mortgage partner, Mortgagebot delivers an intuitive and automated experience from application through closing and servicing.

Optimize your maximum lending potential

Our streamlined, scalable origination solution delivers 40% faster mortgage application process vs manual methods

Integrate with related solutions

Benefit from our seamless connectivity with over 100 pre-integrated partner services such as credit reporting, appraisals, and secondary marketing.

Rely on Finastra's compliance expertise

Finastra’s deep regulatory knowledge ensures your operations stay aligned with evolving compliance standards.

Accelerate loan closing

The combination of Originate Mortgagebot, eSigning solutions and secondary marketing help reduce the origination cycle time by 20%.

Learn how Mortgagebot enables successful outcomes

AI-powered lending transformation

Discover how AI is reshaping lending - boost efficiency, reduce risk, and deliver smarter decisions across the credit lifecycle.

Explore the future of lending:

Cloud-native solution enables a fully-digital future

Enhance the digital mortgage experience

Finastra’s Workflow Automation sets the industry standard by reducing underwriting time from days to minutes and enhancing productivity, accuracy, and profitability.

Integrate with Finastra’s POS

Consolidate your point‑of‑sale to deliver a personalized, self‑service borrower experience across channels. Accelerate time‑to‑close and support compliance from start to finish.

Increase back-office efficiencies

Access more than 100 pre‑integrated partner and fintech integrations to streamline operations, reduce manual work, shorten cycle times, and improve the borrower experience.

The industry’s only true end-to-end origination experience

Loans enter the pipeline via Originate Mortgagebot, Finastra’s highly configurable application interface that automates every point-of-sale application channel with an elegant and engaging user experience design.

Originate applications are pre-integrated with MortgagebotLOS and select third-party loan origination systems, leveraging Finastra’s suite of underwriting integrations to close and fund loans faster… within as little as 7 days.

Mortgage lending software designed for sustainable, scalable growth

Empower mortgage lending in the era of AI and automation

The next generation of artificial intelligence (AI) tools promises to bring new levels of sophistication, speed, and accuracy to the mortgage borrowing process. Imagine lightning-fast approvals and loan closings.

Unrivaled compliance tools to meet all State and Federal regulatory requirements

Finastra is a compliance powerhouse, delivering peace of mind that your mortgage lending is scrutinized for defects, and loans will close without delays.

Redefining productivity while reducing underwriting risk

Finastra’s Workflow Automation, featuring its Rules API capability, sets the industry standard by reducing underwriting time from days to minutes and enhancing productivity, accuracy, and profitability.

Drive mortgage lending growth in a tight market

Deploy strategies that leverage market drivers using Mortgagebot’s capabilities to deliver results efficiently and profitably, empowering financial institutions to plan ahead and strengthen back-office operations.

Finastra's Retail solution suite delivers the future of lending

Finastra’s cloud-enabled LaserPro and Mortgagebot platforms set the standard for intuitive and compliant front-to-back design.

Read the full spotlight:

Scalable architecture backed by 100+ trusted partners

Solution Store from Finastra: Buying made easy

The Solution Store allows existing customers to browse Finastra’s online catalog of product solutions and make purchases with the ease of a few clicks:

- From Compliance Reporter to Data Insights to training, many of Finastra’s state-of-art services are at your fingertips with more being added regularly.

- Enjoy a seamless, efficient experience - when and where it’s convenient.

- Securely purchase services in mere minutes.

End-to-end solutions for mortgages, deposits and loans

Additional resources to support your success

MortgagebotLOS FAQs

Drive accuracy and efficiency with a fully integrated LOS

Connect with our specialists to explore how advanced workflows and seamless integrations can modernize your end‑to‑end mortgage operations