Lending AI expertise

Finastra leverages AI tools to deliver cutting-edge Lending solutions to optimize commercial, consumer, and mortgage lending

Dearborn now leads the market with the best 21st century lending technology. Finastra empowers us to compete and win in the same arena as the biggest local and national lenders.

Scott Biers

Chief Lending Officer, Dearborn Federal Savings Bank

We chose Mortgagebot because it would enable us to develop cutting-edge online and mobile lending services and help us improve our operational efficiency at the same time.

Ted Wiemann

Executive Vice President and Chief Lending Officer, Hoyne Savings Bank

Scalable origination solution that grows with your business

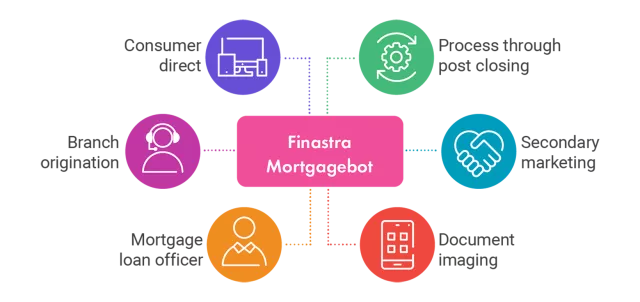

Press play to learn how Mortgagebot helps you streamline origination, boost loan production, and reduce operating costs. Finastra’s cloud-native loan origination system is the industry’s only true fully digital partner, delivering an intuitive, automated experience from application to closing to servicing.

Optimize

your maximum lending potential with a streamlined, scalable origination solution that delivers 40% faster mortgage application process vs manual methods

Integrate

seamlessly with over 100 pre-integrated partner services such as credit reporting, appraisals, and secondary marketing

Accelerate

closing via seamless integration with Originate Mortgagebot, eSigning solutions and secondary marketing, reducing the origination cycle time by 20%

Cloud-native solution enables a fully-digital future

Enhance the digital mortgage experience

Provide customers with automatic pre-approvals and a streamlined multi-channel origination experience

Increase back-office efficiencies

Streamline integrations with Fannie, Freddie, flood, and other vendors while supporting all loan types including construction, home equity, VA, and more

Integrate with Finastra’s POS

Optimize the borrower journey through a fully-automated integration with Finastra’s Originate Mortgagebot solution

Learn how MortgagebotLOS and Originate Mortgagebot enable successful outcomes

Elevate the mortgage application journey

Finastra Originate Mortgagebot empowers financial institutions to deliver a seamless, modern mortgage application journey. By consolidating point-of-sale operations and enabling personalized, self-service engagement across all channels, it enhances borrower satisfaction while accelerating time-to-close and ensuring compliance.

The industry’s only true end-to-end origination experience

Loans enter the pipeline via Originate Mortgagebot, Finastra’s highly configurable application interface that automates every point-of-sale application channel with an elegant and engaging user experience design. Originate applications are pre-integrated with MortgagebotLOS and select third-party loan origination systems, leveraging Finastra’s suite of underwriting integrations to close and fund loans faster… within as little as 7 days.

Mortgage lending software designed for sustainable, scalable growth

Empower mortgage lending in the era of AI and automation

The next generation of artificial intelligence (AI) tools promises to bring new levels of sophistication, speed, and accuracy to the mortgage borrowing process. Imagine lightning-fast approvals and loan closings.

Unrivaled compliance tools to meet all State and Federal regulatory requirements

Finastra is a compliance powerhouse, delivering peace of mind that your mortgage lending is scrutinized for defects, and loans will close without delays.

Redefining productivity while reducing underwriting risk

Finastra’s Workflow Automation, featuring its Rules API capability, sets the industry standard by reducing underwriting time from days to minutes and enhancing productivity, accuracy, and profitability.

Drive mortgage lending growth in a tight market

Deploy strategies that leverage market drivers using Mortgagebot’s capabilities to deliver results efficiently and profitably, empowering financial institutions to plan ahead and strengthen back-office operations.

Scalable architecture backed by 100+ trusted partners

Solution Store from Finastra: Buying made easy

The Solution Store allows existing customers to browse Finastra’s online catalog of product solutions and make purchases with the ease of a few clicks:

- From Compliance Reporter to Data Insights to training, many of Finastra’s state-of-art services are at your fingertips with more being added regularly.

- Enjoy a seamless, efficient experience - when and where it’s convenient.

- Securely purchase services in mere minutes.

Navigating the current (and future) mortgage market

Digital mortgage origination solutions you can grow with