ComplyAdvantage

Transaction Screening & Monitoring with Real-Time AML Data

About this app

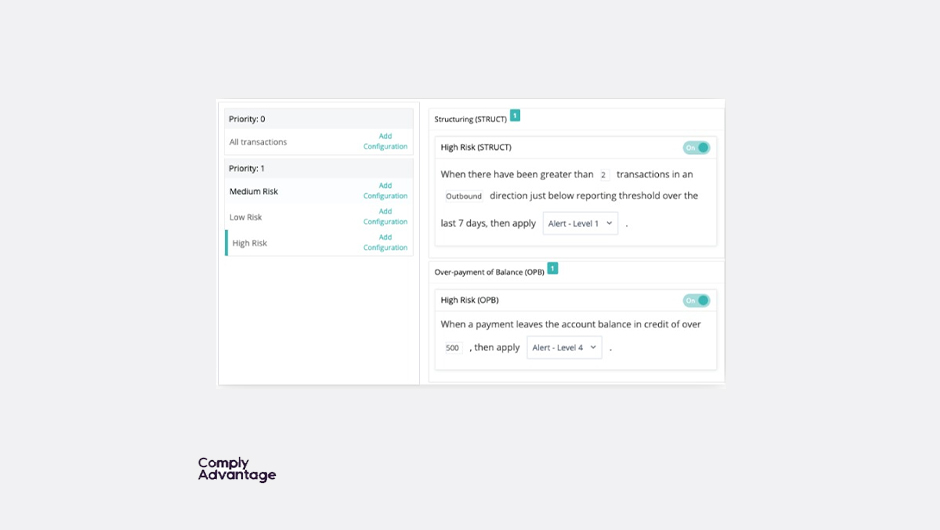

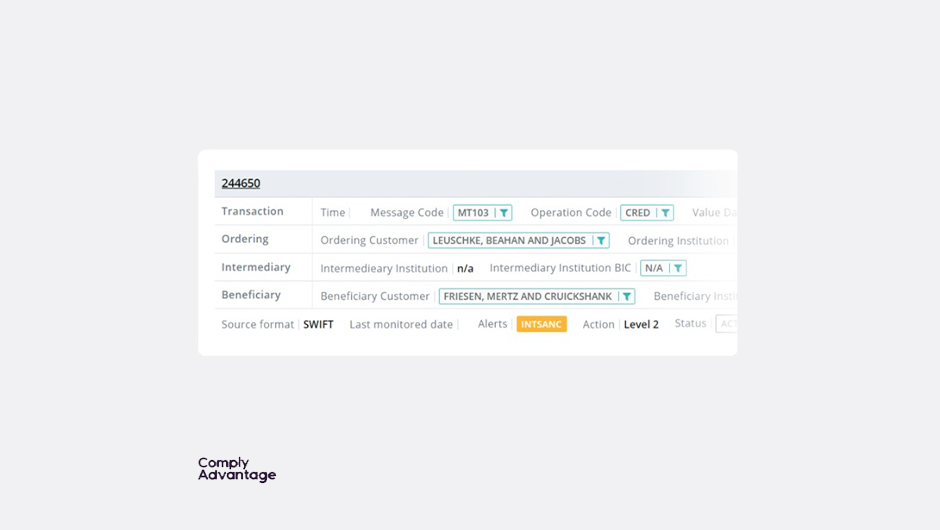

ComplyAdvantage is a transaction screening and monitoring solution based on real-time anti-money laundering data. It helps financial institutions screen, detect, and mitigate anti-money laundering risk. ComplyAdvantage screens parts of the payment against real-time sanctions data and configure rules and policies to quickly review and release transactions, streamlining compliance obligations.

Regulatory bodies often release new guidance for anti-money laundering compliance. This means financial institutions must stay ahead to avoid non-compliance, as it is considered one of the top drivers for enforcing actions and fines. Using legacy solutions can lead to unmanageable alert backlogs and large numbers of false positives, putting the entire compliance program at risk. In addition, customers expect their transactions to be processed without delays. To improve the customer experience financial institutions are moving towards real-time, integrated solutions. This speeds up alert remediation and reduces unnecessary payment delays.

Automated data generation

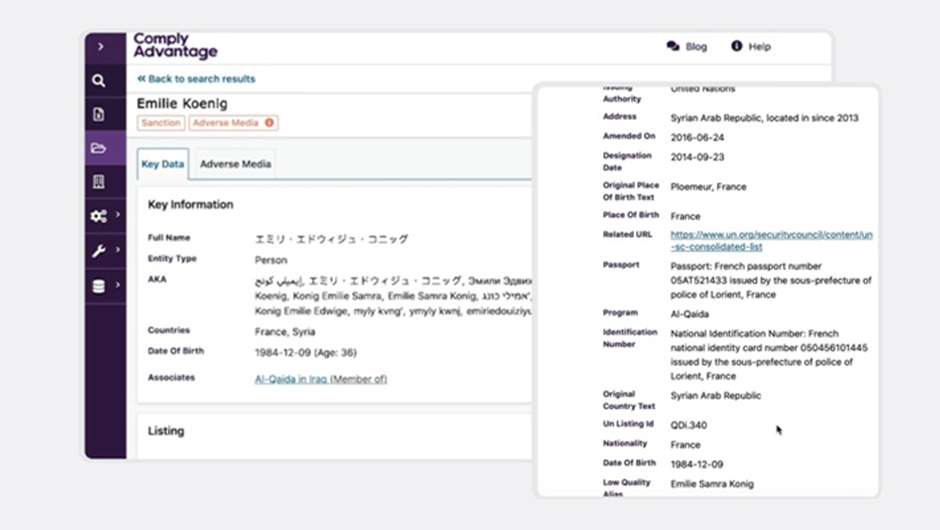

ComplyAdvantage uses machine learning to ensure that data is relevant, up to date and accurate, providing Financial Institutions a solution that is constantly improved.

Powerful search algorithm

The algorithm is configured to a risk-based approach and AI/ML-powered, empowering compliance professionals to act precisely, improving efficiency.

Automated ongoing monitoring with full audit trail

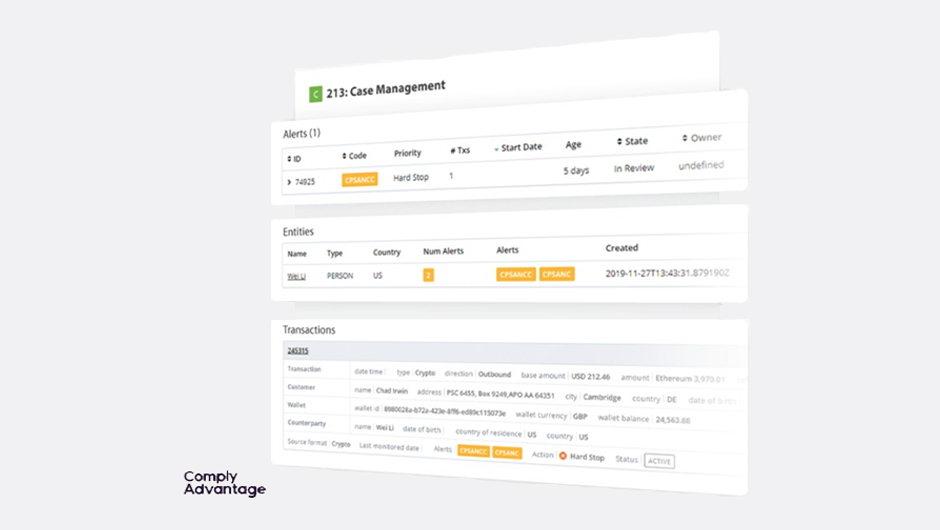

Capture and produce an audit trail of decisions made quickly and efficiently.

Building blocks

Compliance Final Response

Receives a final compliance response following the completion of the investigation by the compliance department

Compliance Analysis

Initiates a compliance analysis request as part of the payment processing flow in High Value and Immediate Payment schemes. Receives an immediate response to the compliance analysis request submitted