Xceed

Comprehensive fraud and AML platform powered by always-on AI

About this app

Xceed provides comprehensive real-time fraud detection and prevention solutions across enterprise silos, channels and products, which enable organizations to identify fraud risk, support effective customer experience, and stop losses before they occur, all on a proven, scalable risk management platform. It can detect fraud perpetrated against the account across many different payment product types, including bill payments, external and internal transfers, wires, P2P payments, interbank transactions such as ACH and payroll transactions.

Real time schemes increase the potential for fraudulent payments. Fraud diversity and real time volumes expose siloed systems, resulting in increased costs and slow reaction speeds. A flexible and efficient infrastructure - balancing reducing customer friction with maintaining low fraud opportunity - this is the key for an effective anti-fraud strategy.

Behavior Analytics for Real-time Fraud Detection

Rules-based fraud models do not understand individual customer behavior and generate too many unnecessary alerts (high false-positive rate) leading to operational inefficacies. Xceed leverages individualized behavior analytics to identify consistent or expected behavior for each customer, as well as activity that is outside the norm (higher risk) across all channels, overcoming indiscriminate and inefficient systems that have an adverse impact on customer experience.

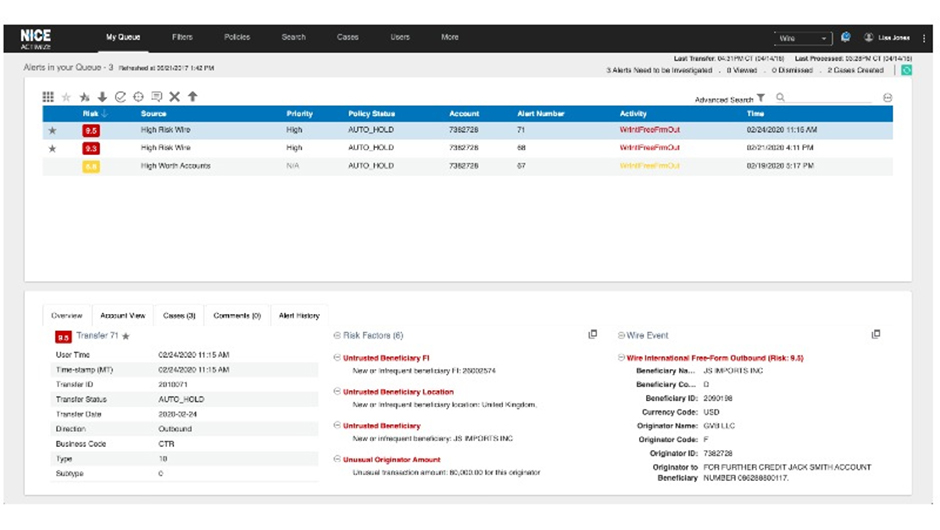

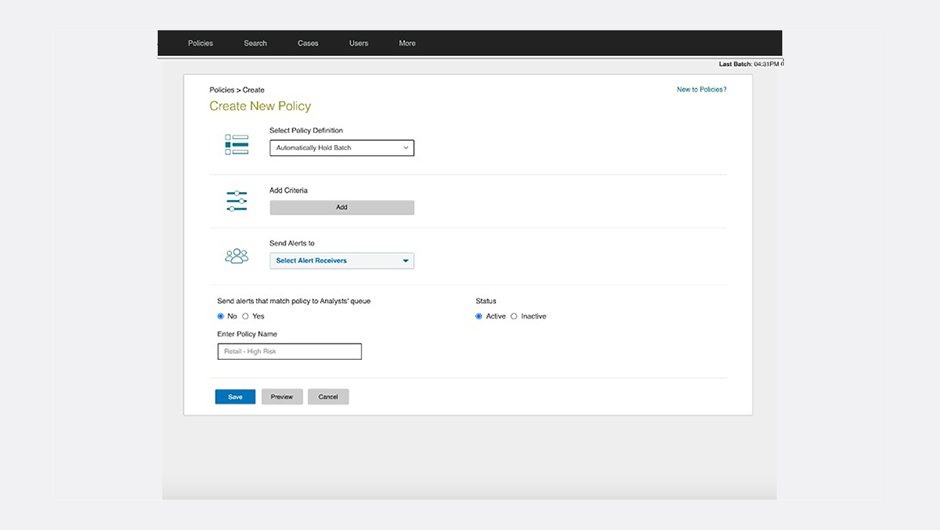

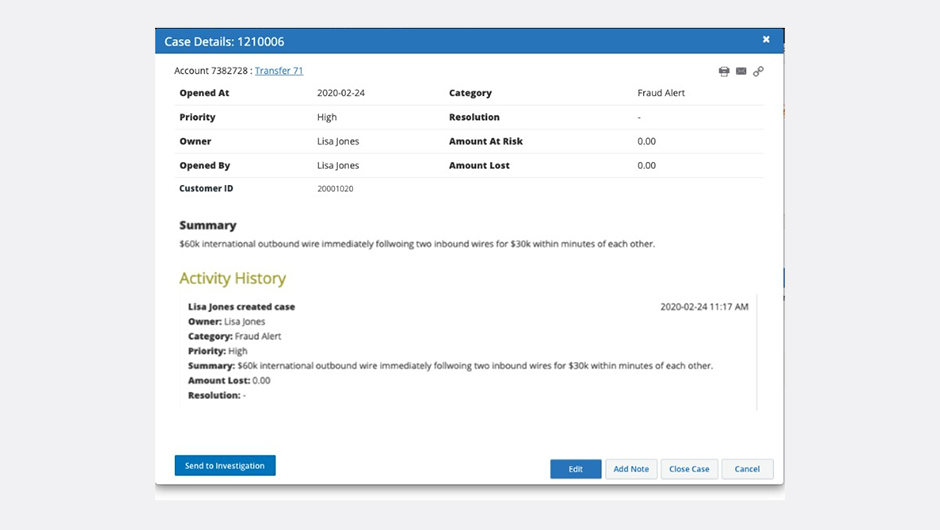

Adaptive investigations for maximizing operations capacity

Best-in-class case management and data aggregation to automatically discover relationships and linkages, expediting alert and case investigation to cut down investigation costs and overcome the slow, labor-intensive methodology of siloed teams that result in poor detection of financial crime.

Holistic data view for accuracy and scale

Pre integrated to 65+ cores, including Fusion Global PayPlus, government & biometric data. Xceed offers standardized interfaces for new cores - for quick deployment and accurate, centralized cross channel, high volume fraud management. This flexibility avoids disjointed tools that lead to fragmentation and poor fraud analysis results across multiple channels.