Payment Fraud Prevention

Ready-to-go solution for real-time fraud prevention

About this app

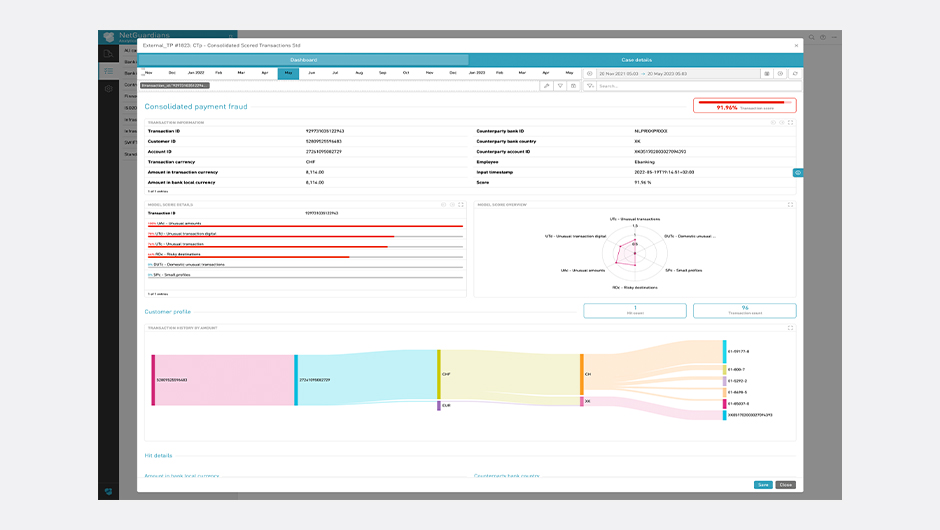

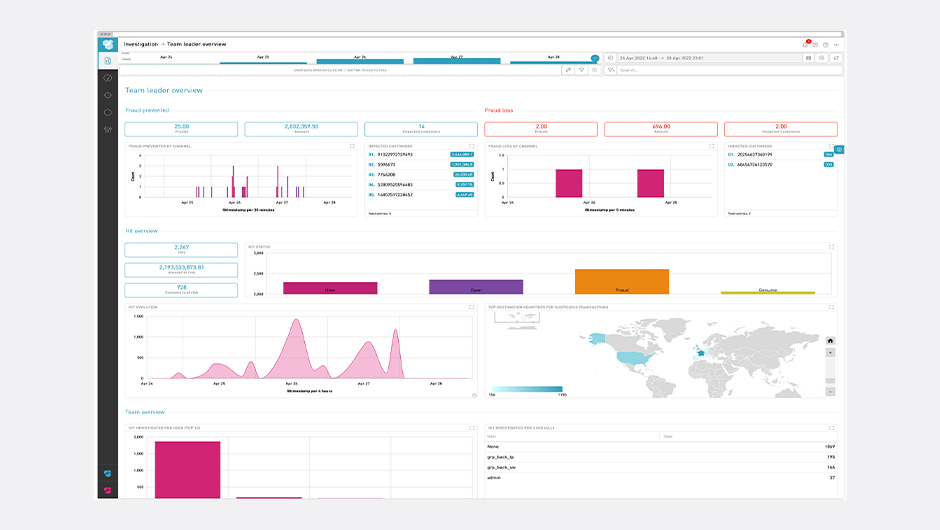

NetGuardians’ AI-powered fraud solution more accurately detects and blocks fraudulent transactions. It learns each customers behavior and flags anomalous transactions for further validation. System reduces false positives by 85% - this results in +75% operational cost savings as fewer staff are needed to validate suspicious payments - direct savings for a Bank and reduced reputational risk.

Fraudsters are increasingly using social engineering techniques to perform scams such as fake invoice, CEO fraud, and business email compromise (BEC), among others. The fraud losses are forecast to net $10.5 trillion a year by 2025.

NetGuardians’ solution helps Finastra banks to tackle these challenging scams by understanding the normal payment behavior of each customer and using behavioral AI risk models to detect anomalous payment transactions that are outside the norm. It spots and stops fraudulent payments resulting from both internal fraud and external fraud.

Pre-integrated with Finastra core banking, payments, and cash management systems, the solution can be live in weeks by simply activating it on FusionFabric.cloud so banks can quickly reduce their project management costs, decrease fraud losses, and protect their customers.

Regain customer trust

High misdetection & false positives cause bank/ customer losses, and customer loss of trust.Use behavioral risk models to gain their trust back.

Reduce operational costs

The platform is preintegrated, does not require any rules for maintenance and adapts to diverse customer behaviors, reduced false positives, intuitive operator UX.

Future-fraud proof

Current rules are programmed to detect known fraud scenarios but miss the new ones. The Payment Fraud Prevention app uses behavioral models that self-learn and are able to detect new fraud types.