Fincom.co's AML Screening

Add-on module to enhance your current AML screening system

About this app

Fincom.co’s Real-Time AML compliance solution uses purpose-built, supervised Machine Learning with “Phonetic Fingerprint” technology. It allows for screening high volumes of transactions at low latency, from multiple languages and industries, while dramatically reducing false positives without missing hits.

In a world where financial transactions are becoming immediate and demand real time verifications, manual processes under AML compliance consume enormous resources that result in extremely high operational costs. Moreover, US AML regulations are becoming even more strict: lower amounts, more and more industries must comply, fines are getting bigger and personal liability is now official. Fincom.co’s Real-Time AML compliance solution aims at addressing those 3 main challenges in ALM today.

Real-time low latency screening

AML verifications using rules-based/libraries solutions take between 3 seconds to 3 minutes on average. Fincom’s solution speeds up the process by evaluating the transactions against the largest Sanction/PeP databases, performing an accurate, precise screening under 200 milliseconds, while still ensuring "No Misses".

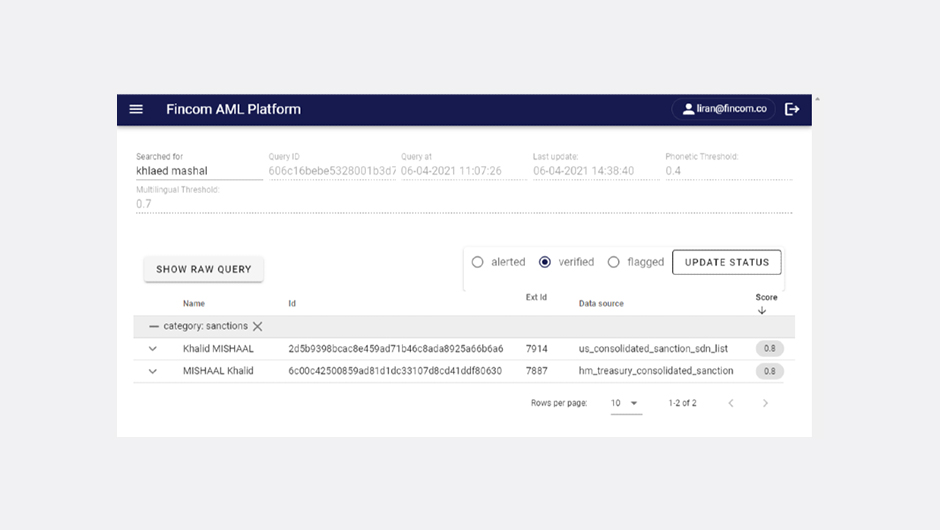

Greater accuracy while reducing false positives

Financial institutions hire thousands of trained expensive HR, costing up to 10% of the entire operational costs on financial crime only to screen false positives. By using a supervised machine learning technology, the false positive rate can be reduced by over 50% from the industry standard.

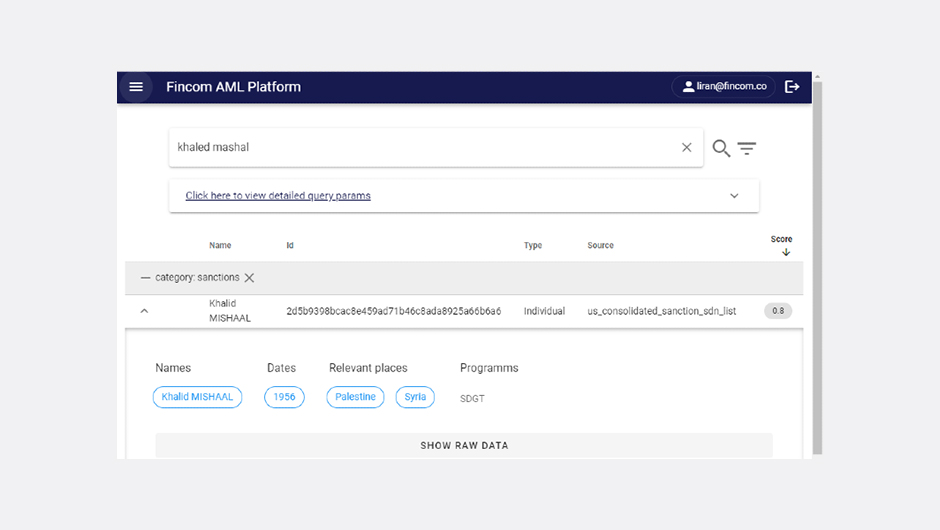

Multilingual “no miss” by Phonetic Fingerprint

Financial Institutions are fined due to outdated technology that can’t keep up with the diversity & volume of industries & languages. Using a mathematical representation of the way the spelled name sounds, this enables matching names at far greater accuracy, eliminating the problem of spelling variations with over 38 pre-built languages.

Building blocks

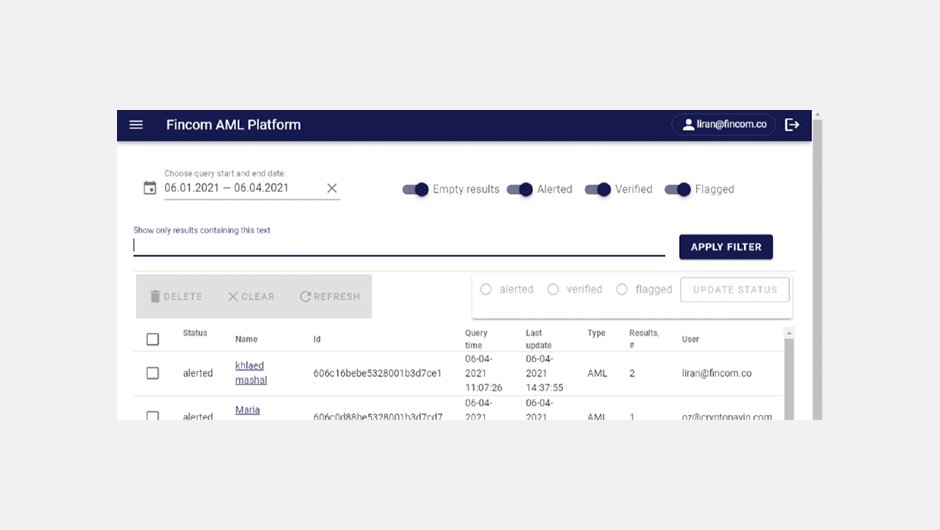

Compliance Final Response

Receives a final compliance response following the completion of the investigation by the compliance department

Compliance Analysis

Initiates a compliance analysis request as part of the payment processing flow in High Value and Immediate Payment schemes. Receives an immediate response to the compliance analysis request submitted