Finastra LIBOR Transition Calculator

Calculating Alternative Reference Rates for applications unable to calculate their own ARR based interest accruals

About this app

With the replacement of the interest rate benchmark LIBOR to Alternative Reference Rates (ARR), banks and corporate borrowers must be prepared for this challenging and complex operational transition.

Legacy systems in lending institutions cannot process Alternative Reference Rates (ARR) or Risk-Free Rates (RFR)-priced loans, because they weren’t designed to perform these calculations and implementing complex system changes can be costly. Corporates need a quick, easy and accurate way to reconcile or validate ARR-based interest calculations that is flexible. This solution must be able to expand over time as ARR / RFR methodologies evolve.

The Finastra LIBOR Transition Calculator enables lenders and corporates to calculate ARR/RFR-based rates and interest accruals. It independently sources the ARRs/RFRs from exeternal, official market data sources, and calculates ARR rates based on the recommendations of key market conventions, along with corresponding interest accrued amounts for a given set of inputs.

Introducing the Finastra LIBOR Calculator web-app

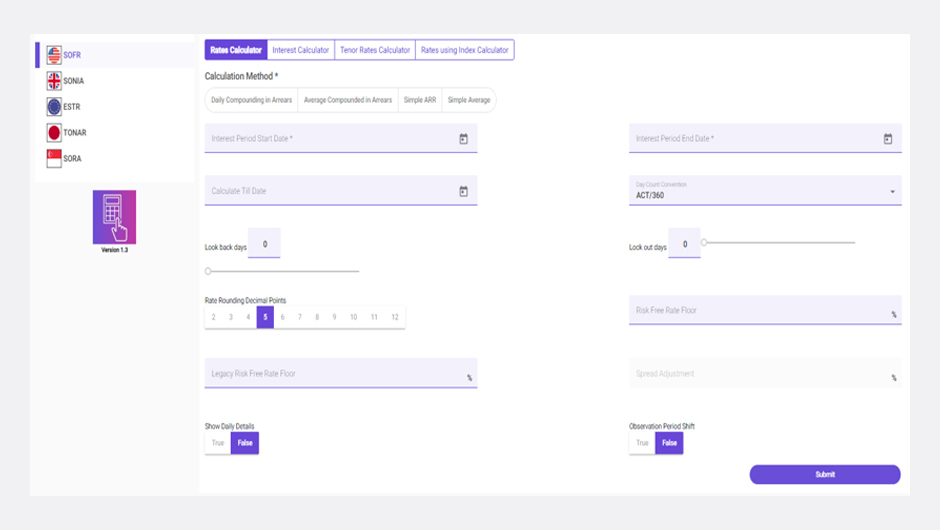

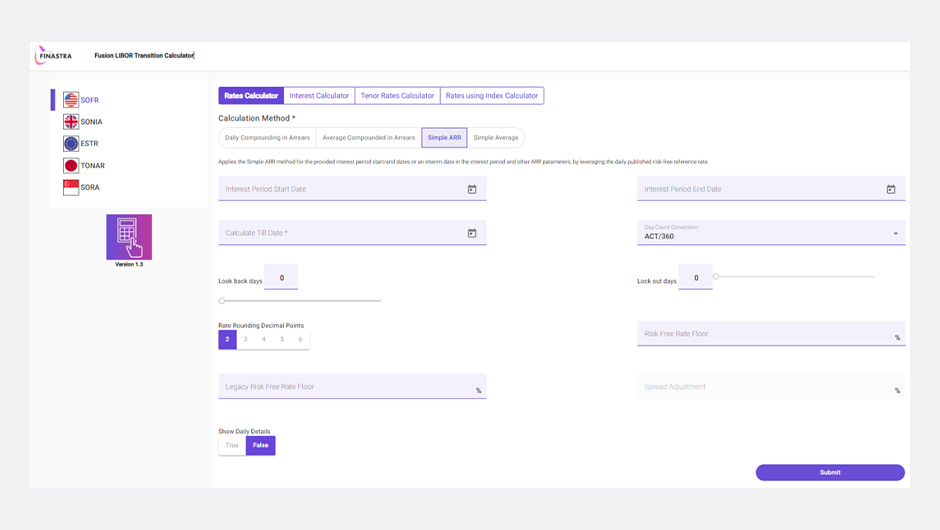

The Finastra LIBOR Transition Calculator is now available as an intuitive user interface (UI) on the FusionStore. Clients can access the web-app as a SaaS solution to perform / validate ARR calculations, without any additional infrastructure, technology, or software maintenance costs.

To check the app in a sandbox environment, click on the “Demo app” button. Note that you should be signed into your FusionStore account to access the demo app; the demo app only supports limited, historic rate data – from 1-Jan-2019 to 31-Dec-2020.

A detailed user guide is available at the following link (Document Name: “Finastra LIBOR Transition Calculator – Web App User Guide”):

A trusted methodology

The solution supports all of the key recommendations from the ARR loan market conventions

Seamless integration

The open API-based offering can integrate efficiently and seamlessly with legacy systems

Future proofing your business

Finastra possesses the knowledge and expertise to innovate with evolving market needs

Building blocks

Corporate Lending Alternative Reference Rates

Provides an Alternative Reference Rates (ARR) calculator service to applications that are unable to calculate their own ARR based interest accruals