Agency Banking

Extend your services beyond the branch through local shops and agents serving customers on your behalf

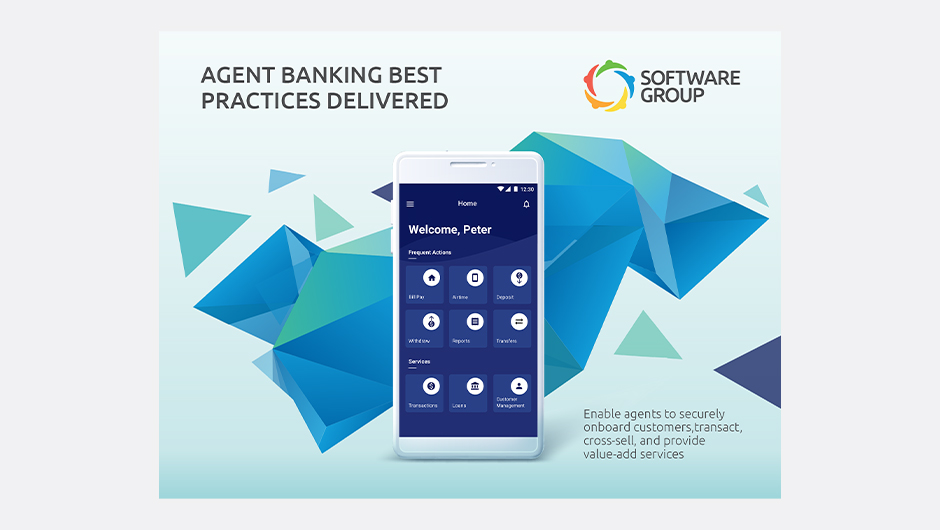

About this app

Software Group’s Agency Banking Solution (AB) enables banks to scale their points of service cost-efficiently, without having to expand their branch or ATM network. Through local agents, banks can drive customer acquisition and deposit mobilization, expand market share, reduce branch costs, and achieve high profitability, delighting customers with convenient banking & value-add services.

In emerging markets, banks are pressured by high competition from non-traditional players who are offering basic financial services through convenient mobile solutions. Customers, though geographically dispersed, demand local and convenient access to these services and choose the financial service provider that responds best to their needs. It is important for banks to overcome the high CAPEX & OPEX costs associated with branch expansion, reduce customer onboarding time, and leverage the clients from underbanked regions as an opportunity for new sources of revenue.

All-in-one platform

Using its 12+ years of experience in developing markets, Software Group delivers an established, best-practice platform that ensures convenient experience for both customers and agents at every trusted agent touch point. It empowers accessible, reliable and quality services, offers a complementary mobile wallet, supports high transaction success rates through user-friendly agent apps, and earns customer and agent loyalty with the financial institution.

Reduce costs

The solution addresses banks’ needs to reduce operational costs – manual, paper-based tasks – by helping them avoid the high-capital investment and complexity involved in opening and running new branches. Instead, banks can acquire and serve new and existing customers through agents, which reduces customer onboarding and servicing costs substantially.

Purpose-built to drive profitable growth

The solution drives profitability for banks by facilitating deposit mobilization and offering a multitude of value-add transactions that generate additional revenue from both customers and non-customers (bill payments, airtime top-up, remittance, digital loans, etc.). Forrester Consulting TEI study found that Software Group’s AB brings 369% ROI in just 3 years, a payback period of only 8 months, increased fee revenue from a larger customer base, and cost efficiencies from reduced customer onboarding time.