AIO - Powering Financial Decision-Making

Capture. Validate. Finance. AIO Powering Financial Decision-Making

About this app

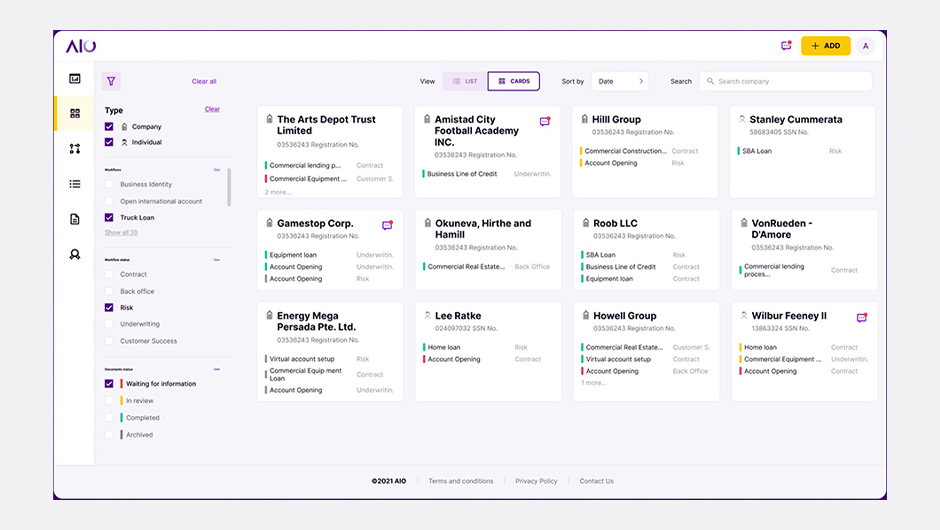

Lenders trust AIO’s intelligent platform to capture and auto-verify documents from new and existing borrowers. As a result, lenders can instantly surface missing, expiring, or problematic documents, allowing them to underwrite and review loans faster with fewer costs.

In 2020, 33% of commercial lending requests were submitted to online lenders. The average time for loan approval is 26 days for physical banks, whereas emerging online lenders are supplying funds in as little as 1 to 7 business days. This is because many community banks and credit unions are overwhelmed by workload of incoming loan applications that require slow, manual data collection processes and hybrid online/offline loan request processes. Printed/emailed checklists for customers and physical submission at the branch

- AIO's easy-to-use digital platform simplifies the loan application and monitoring process to compete with large banks and non-bank lenders.

- AIO's intelligent All-in-One platform reduces manual efforts spent on collecting, reading, and verifying initial and ongoing documents.

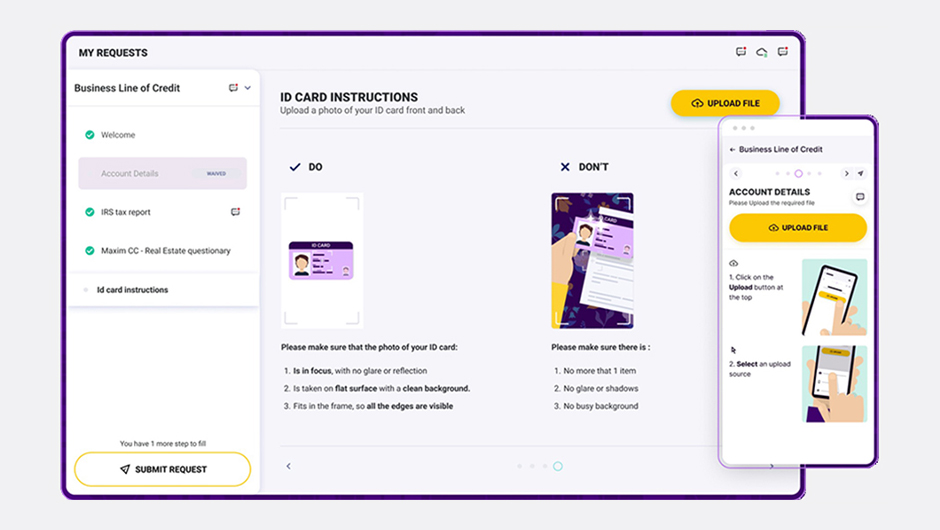

Digital Customer Portal

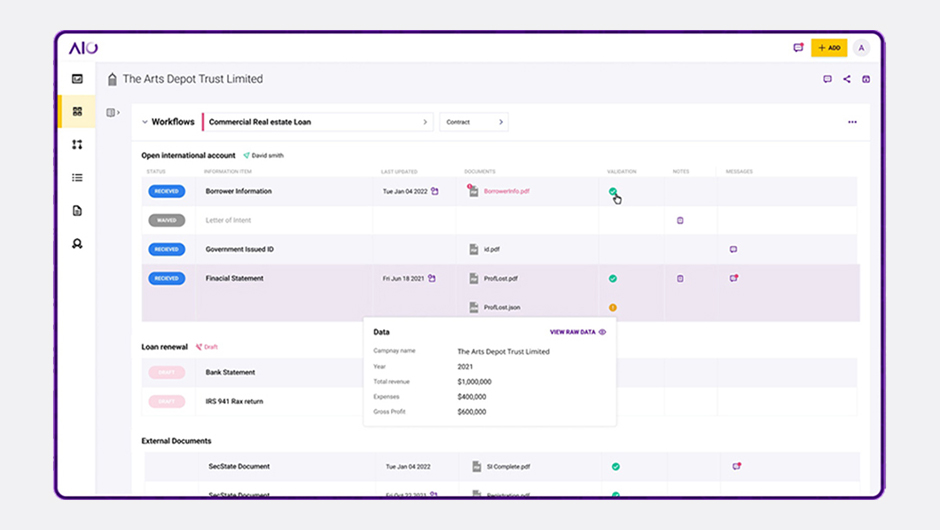

AIO's All-in-One platform provides borrowers and lenders with a central easy-to-use portal for documents, online forms, and signatures, rather than dealing with paper, emails, and documents scattered in disparate locations.

Auto Validation of Documents

AIO's Artificial Intelligence automatically verifies documents, alerting borrowers and lenders of wrong, missing, or expiring documents instantly, rather than days or weeks later into the process.

Speed to Market

AIO's platform allows banks and credit unions to approve, review and monitor more loans faster with the same team. In addition, AIO can be set up within weeks, not months.

Building blocks

Party

Search and return records for entities (parties) in the loan origination system records

Fusion LaserPro Cloud Connect - Commercial

Provides connectivity for Loan Origination systems to submit commercial loan transaction data to the Document Generation system.

Fusion LaserPro Cloud Connect - Consumer

Provides connectivity for Loan Origination systems to submit consumer loan transaction data to the Document Generation system.

Commercial Lending Documents

Uploads documents supporting commercial lending to the loan origination system of record. Document uploads include index values to support search and record retention

Collateral

Call to the loan origination system of record to access details about collateral securing the institution's commercial loans

Credits

Call to the loan origination system of record to create new loan requests and access details of existing loan balances and terms and rates

Fusion LaserPro Cloud Connect - Configuration

Integration with Independent Software Vendors