Corporate/SME Loan Origination

The ApPello Corporate LOS is an end-to-end solution enhanced by user-friendly features designed for corporate lending.

About this app

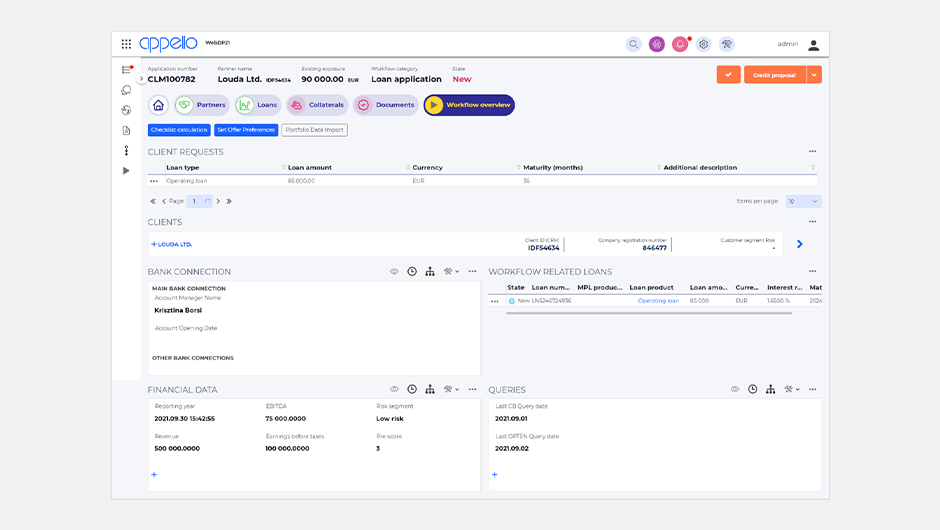

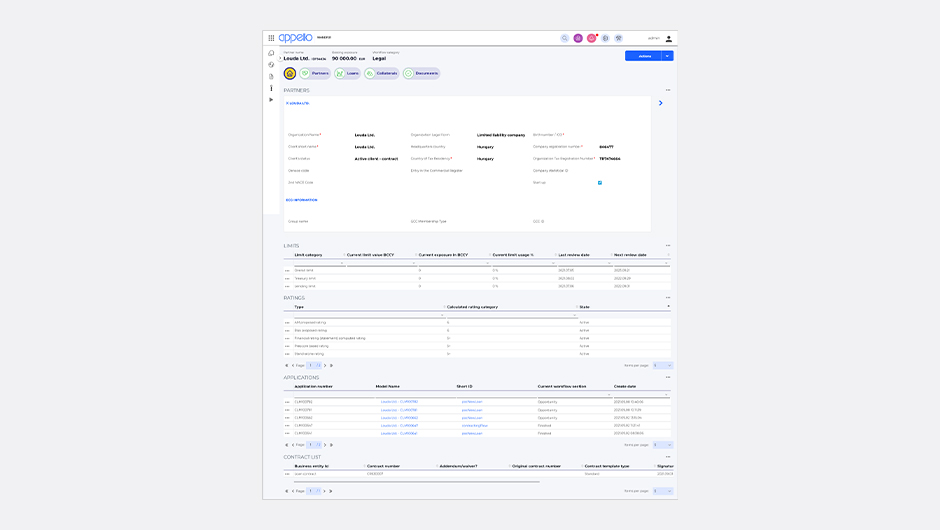

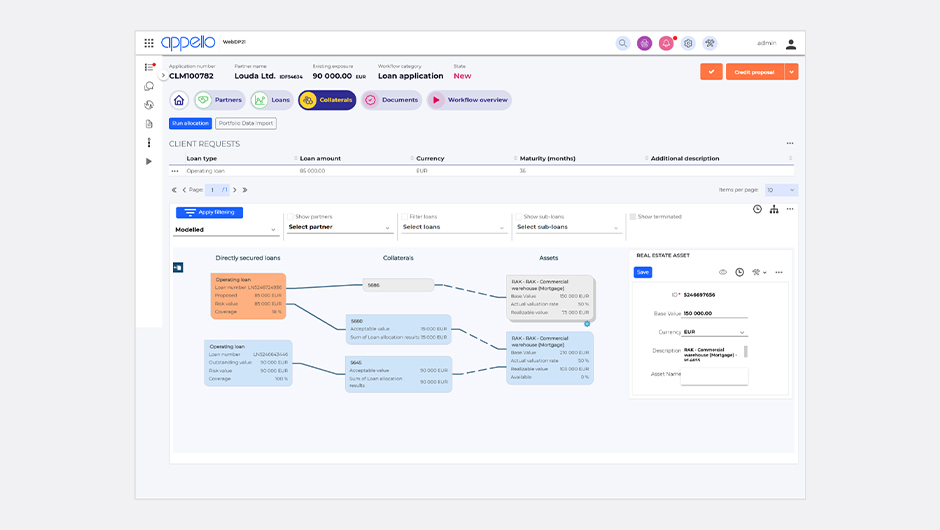

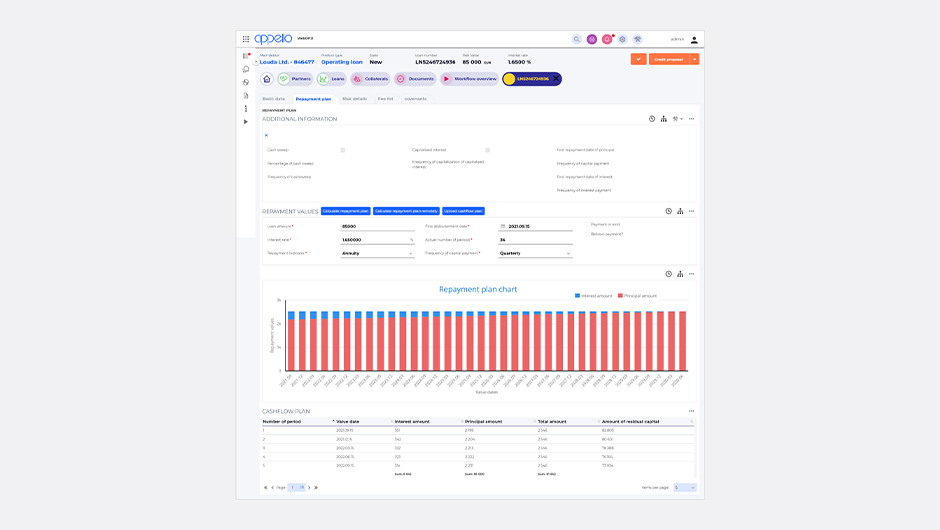

The system can handle complex product and company structures. It covers the lending process from the first interaction with prospects to disbursement, the monitoring processes and miscellaneous secondary operations processes like restructuring, termination. The whole credit lifecycle is supported by Camunda BPM and Document Management. Beyond these processes the solution unifies any related loan and collateral administration as well as covenant handling.

ApPello’s Loan Origination solution is built up with a modular approach and they can be used according to Bank’s architectural and business decisions.

Improved Sales efficiency

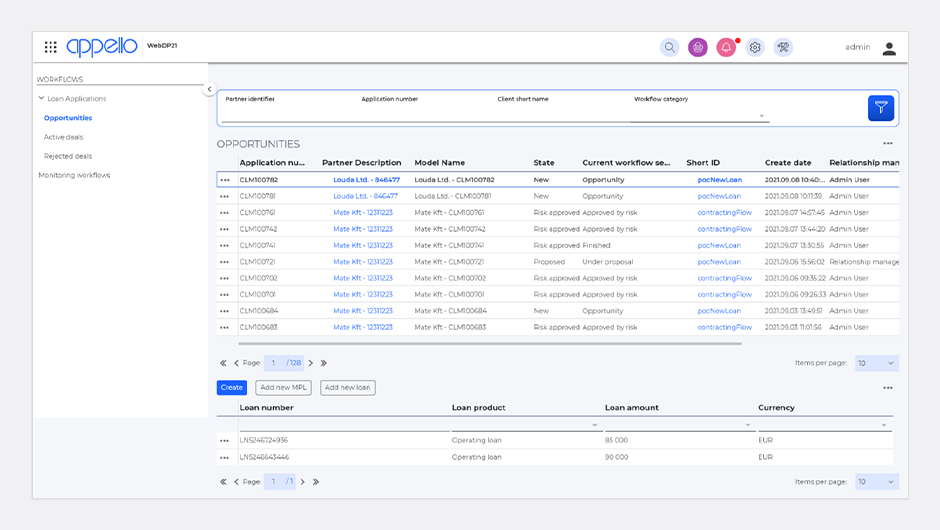

Customer satisfaction by increased speed and process experience (outstanding Front End & Back End design and optimized process) Quick response to market needs (with the help of the outstanding flexibility toolset) Enhanced efficiency & productivity resulting in shorter time-to-yes and time-to-money and thus customer satisfaction (using easily configurable and measurable workflows) Easy-to-adjust credit policies & business rules (with the help of Decision Engine)

Reduced operational cost

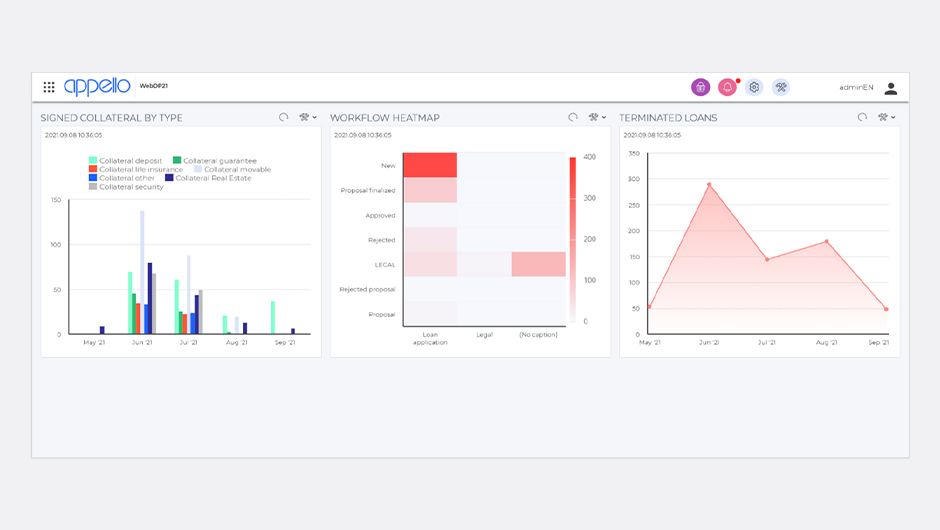

Low TCO by easy customization (with the help of the outstanding flexibility toolset) Enhanced team performance through monitoring, reports & dashboards Quick & cost effective introduction due to rich existing functionality Risk decrease with implemented business rules and validations (at least 50% business rules are in rule engine, not hardcoded)

Configuration over Customization

The ApPello LOS system is a set of configurable modules that enables ApPello (and the Bank as well) to create and modify the Bank-specific LOS solution mostly without customization (programming) from an existing, pre-configured base system.