HUBX Arranger

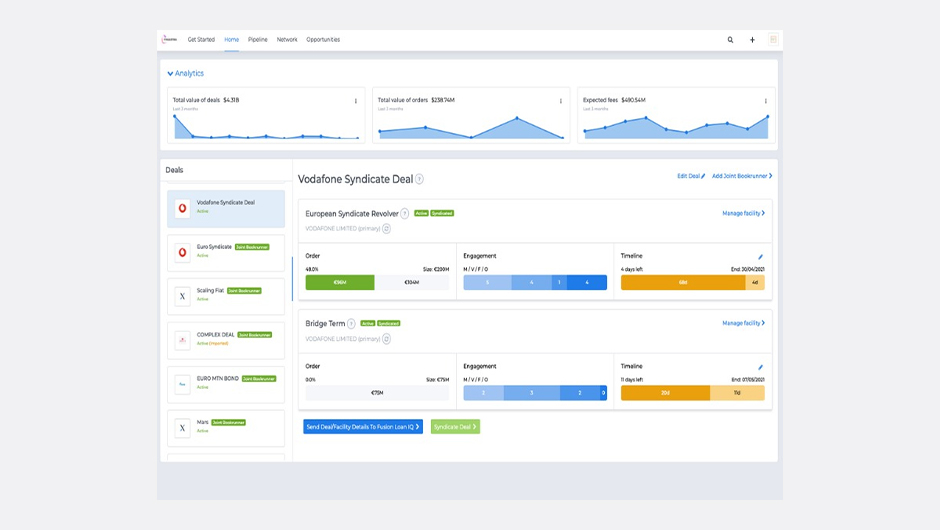

HUBX Arranger is a data-driven primary and secondary loan syndication platform integrated with Fusion Loan IQ.

About this app

HUBX digitizes the entire cycle of syndicated deals arrangement, across all types of deals, from deals/static data extraction from Fusion LoanIQ, via deal creation, investor matching, doc sharing/feedback, to ordering and booking to Fusion LoanIQ.

With the rise of Fintechs offering direct digital specialist lending and regional banks expanding into complex lending, arrangers become highly sensitive to smaller deals pricing and to providing a retail-like experience as expected by less sophisticated corporates. But their ability to compete on price and experience is hindered by lack of automation, the non-digitized experience they provide, and their inability to effectively use the data they have on borrowers and lenders to generate new business. HUBX can help Arrangers to easily address these challenges.

Digitized system to extend reach & compete

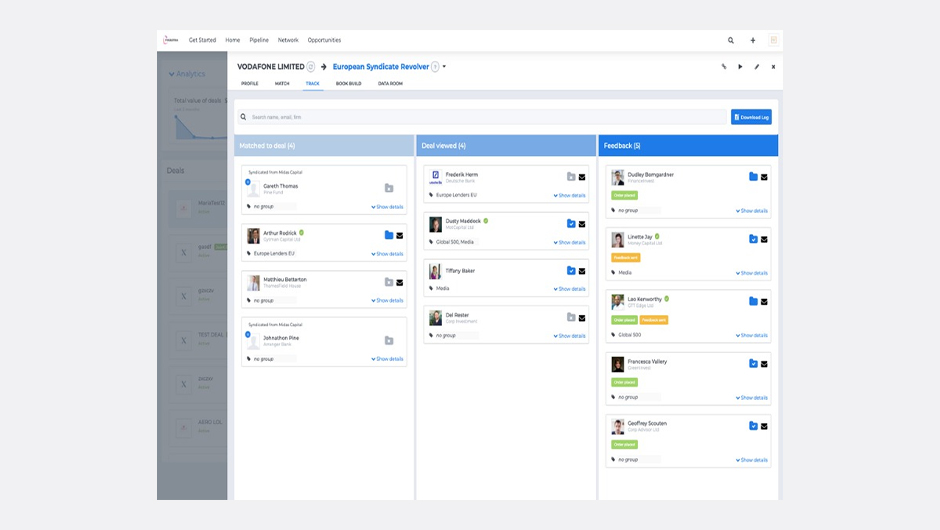

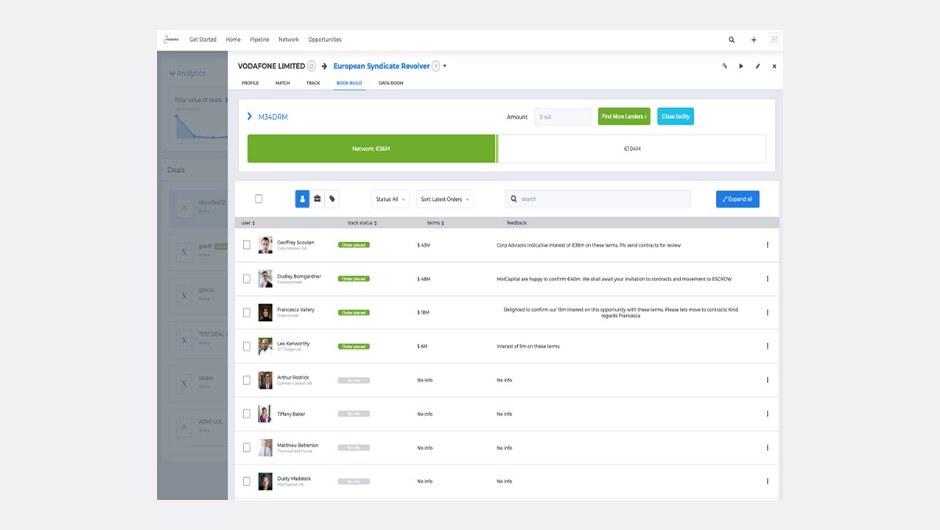

Overcome the high costs of manual/partial automation. Improve efficiency by simplifying communication, digitizing & automating investor search leveraging matching algorithm capabilities and automating key activities through the syndication bookrunning process - all resulting in the ability to offer competitive pricing, even on small deals.

Multi sided digital experience to optimize customer experience

Improve customer experience through bank branded portal, seamless deal transition from primary to agency phases, and a data driven matching algorithm between borrowers and lender. HUBX eliminates manual hand-offs in onboarding, in syndicated deal marketing, and in of investor orders - all of which result today in less-than-optimal customer experience and slow response.

Scalable through integrated data & commercial model

Underutilized fragmented data inhibits potential growth. Scale up, reduce errors, and improve risk management by having comprehensive data for matching lenders to borrowers, and auditing deal interactions with lenders.

Building blocks

Corporate Lending Alternative Reference Rates

Provides an Alternative Reference Rates (ARR) calculator service to applications that are unable to calculate their own ARR based interest accruals