Jifiti

White-labeled POS finance & Buy Now Pay Later (BNPL) solution for merchants, banks & platforms connected to lenders

About this app

Finastra’s Point of Sale (POS) Financing solution powered by Jifiti enables financial institutions to easily deploy consumer financing options at any point of sale - online, in-store and via call center.

With BNPL on the cusp of regulation, merchants are increasingly turning to BNPL options from lenders. As a white-labeled platform, Jifiti empowers financial institutions to increase and reclaim their consumer financing market share. With our zero to simple merchant integration options, financial institutions can easily onboard merchants at scale and cut merchant onboarding time by up to 90%.

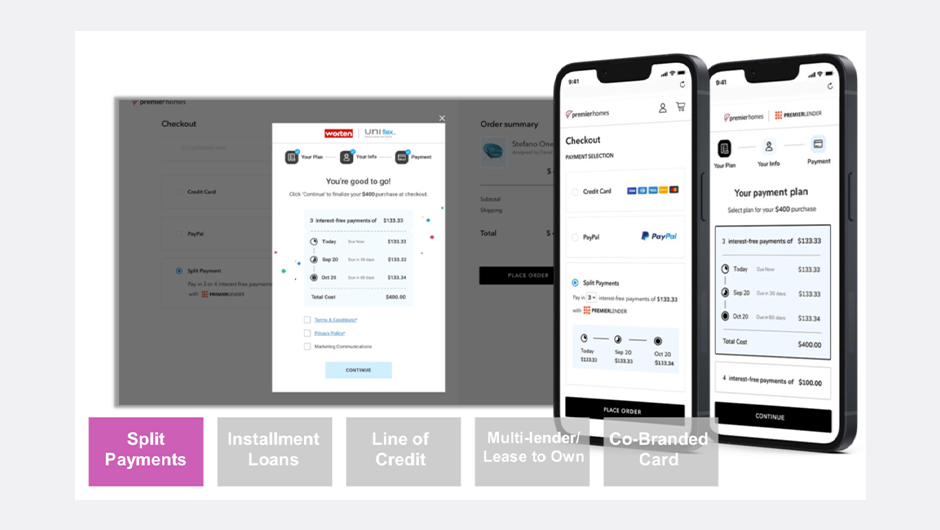

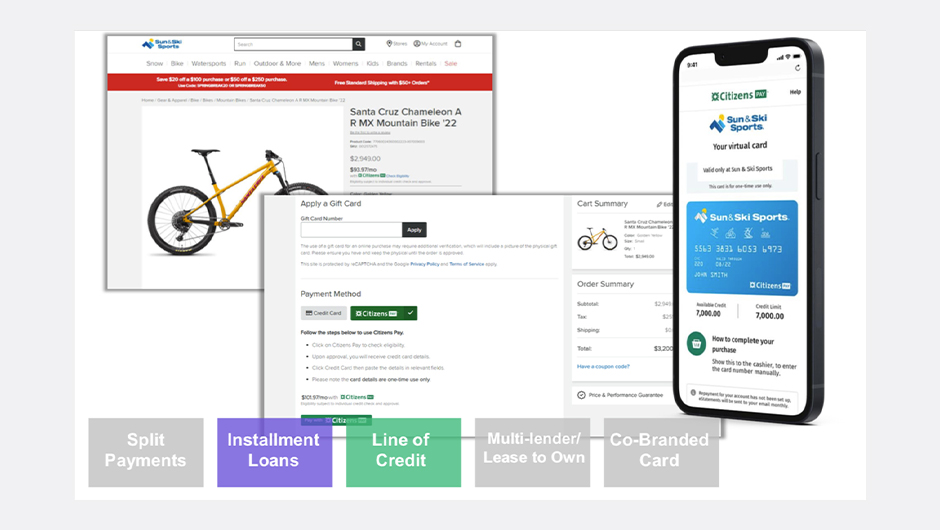

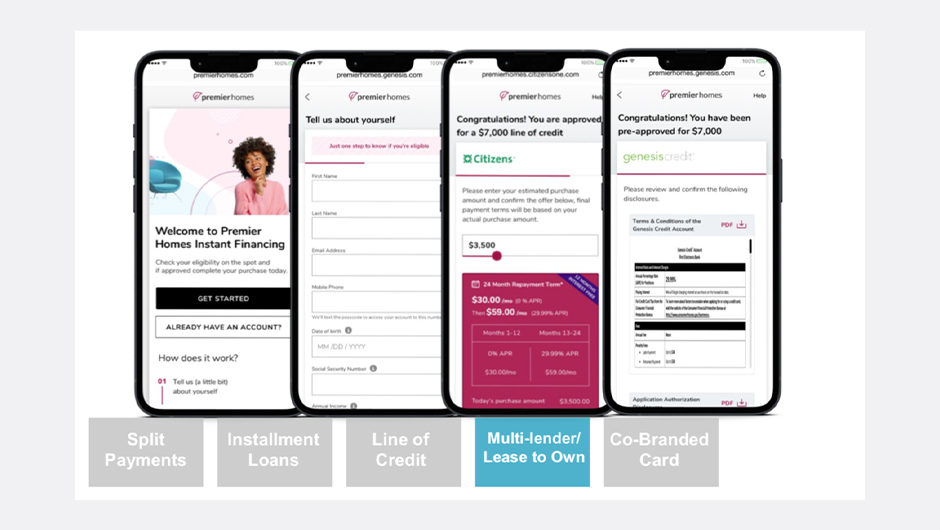

A single integration with our platform provides access to the full spectrum of BNPL options, functionality and payment stack options for the merchant. Our solution is fully configurable to meet the specific requirements of you and your merchant.

Jifiti gives lenders the flexibility to decide what type of pay-over-time option to offer for different ticket sizes and categories.

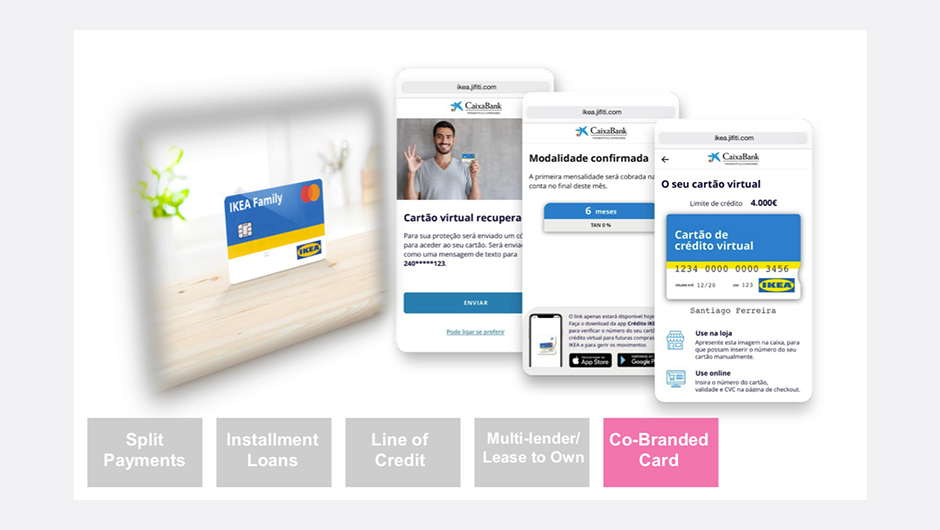

Fully white-labeled & customizable

Jifiti’s BNPL solution is white-labeled for the lender and merchant, helping you and your merchant customers build your brand equity and increase customer retention.

Single integration, unlimited scalability

One integration with Jifiti’s platform gives you unlimited scalability. Lenders can onboard merchants quickly and easily, at scale.

Powers every BNPL possibility

Our solution supports every user journey (online, in-store, via call center), every consumer financing product (split payments, installment loans, lines of credit, lease-to-own) and every payment stack.