Mobile Strong Customer Authentication (SCA)

A customer authentication solution to balance safety and convenience in the open banking compliance framework.

About this app

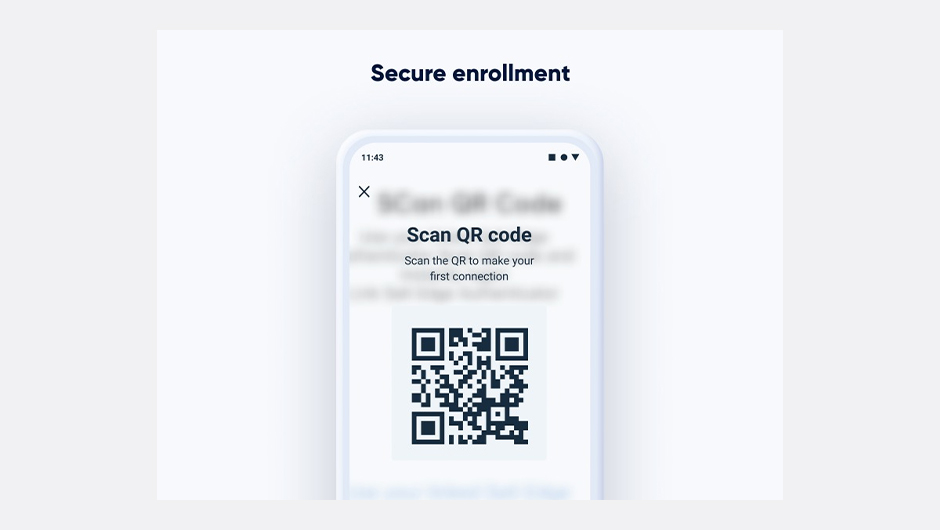

Salt Edge has developed the stand-alone Mobile SCA application to handle dynamic linking and meet the strong customer authentication requirements. The solution adds an additional security layer, simplifying the access to banks’ and EMIs’ digital channels, granting a user-friendly authentication and authorization process.

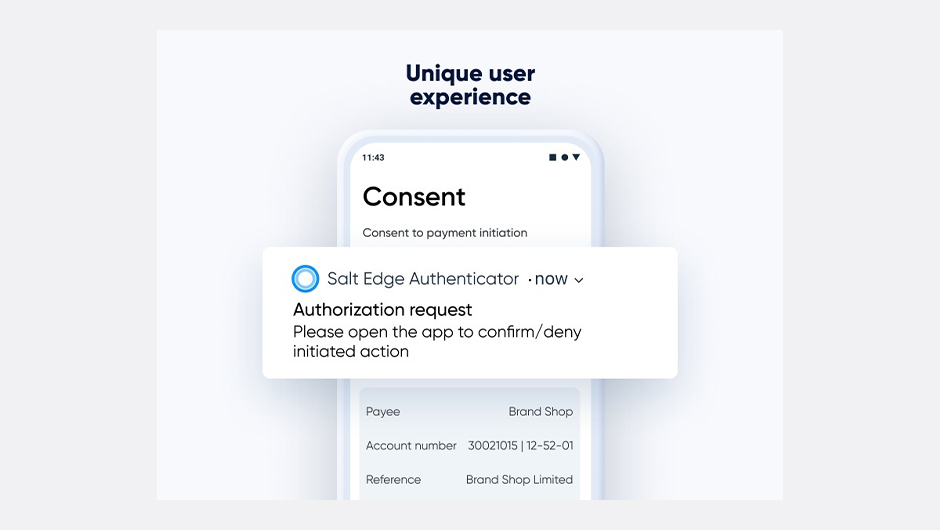

The Mobile SCA can be used as a second authentication factor to login into web-banking; to authorize payments initiated both from TPPs’ app or banks’ web-banking, to confirm the consent granting for 90 days for AIS flows, and much more. The app supports all three SCA elements mentioned in RTS (possession, inherence, and knowledge), the user being able to approve or deny the relevant action. Salt Edge Mobile SCA combines the world's best UX and security practices to offer banks a solution that makes your business and customers' payment experience much better and safer.

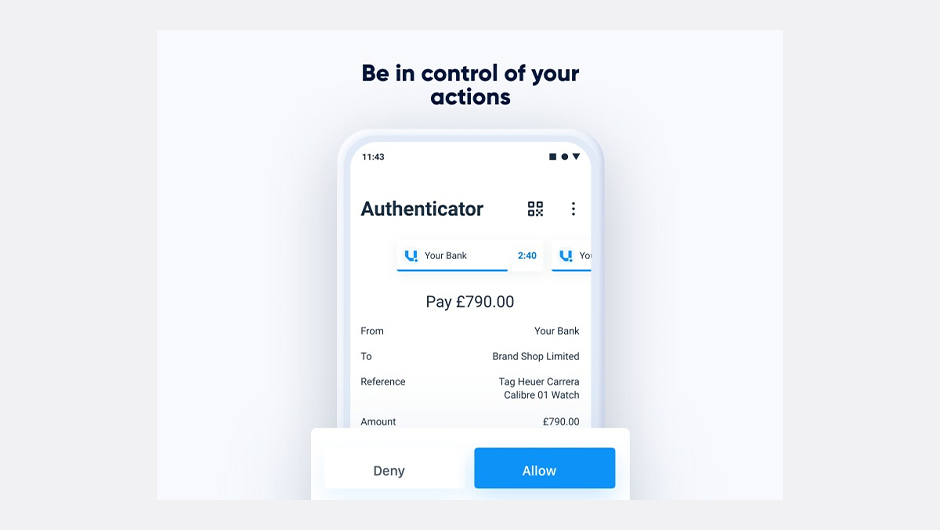

With Mobile SCA, electronic transaction authorization is performed by the method: “What you see is what you sign”. The app transparently displays the information before end-customer approves or denies the action, just like RTS requires:

- Amount of transaction

- Payee’s details

- Bank/payment rates

- Exchange rates.

Some of Mobile `SCA’ most important benefits are:

- Easily enables compliance with SCA requirements

- Reduces fraud risk

- Comes in multiple implementation options, for any client’s convenience

- Has a wide range of business applicability, including purchase approvals, reduce password resets, and exclude account takeovers

- Combines the world’s best UX and security practices.