TradeAI

Save time and reduce risk by automating the examination of your documents under a Letter of Credit.

About this app

We are on a mission to help banks on their digital transformation journey and accelerate their trade finance business. By empowering Operations, Compliance and Relationship Managers, you will be able to improve operational efficiency and free up their time to focus on better serving your customers. Join us on this journey!

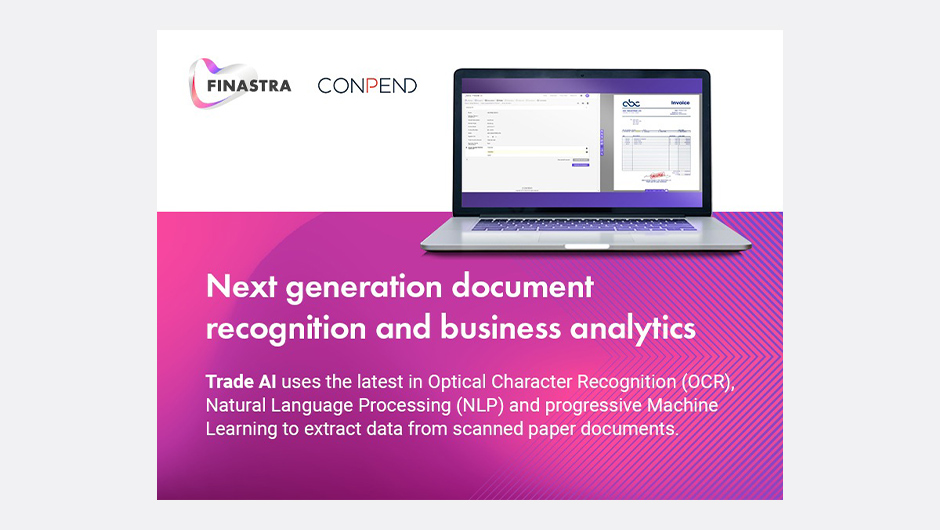

TradeAI helps save time and reduce risk by automating the examination of your documents under a trade instrument such as a Letter of Credit. Simply upload your documents, along with the Letter of Credit, and immediately receive comprehensive reports on the compliance of the documents against ICC standards and relevant regulatory requirements. This includes profiling of the transaction for money laundering and terrorist financing risks, and enables monitoring during the transaction lifecycle.

Key features

- AI-powered document recognition and data capture

- Automatic sanction and embargo screening

- Automatic trade-based money laundering screening based on BAFT guidelines

- Automatic examination of documents under an LC according to the UCP 600

- Automatic documentation of all actions and decision in a comprehensive audit trail

- Advanced workflow supporting four-eyes principle and multiple conditional escalation steps

- Highly customizable to specific business processes

- Seamlessly integrated with Fusion Trade Innovation

Finastra Fusion Trade Innovation + Conpend Trade AI = next-generation trade ecosystem

The demand for paperless trade, increased automation, and availability of non-bank and third-party services is giving rise to new business models and ways of working. Fusion Trade Innovation, coupled with FusionFabric.cloud, allows banks to address these dynamics through unique technology partnerships and integrations. A move towards end-to-end digital trade transaction processing ecosystem.

Reduce Risk

100% coverage: Examines all text within all documents, not solely the specifics the user extracts.

Lower error rate: Point and Click is more accurate than data entry. The document class approach

enforces greater precision

Watertight audit trail: Alerts are linked to actual documents. All documents and correspondence

related to a transaction is stored in one place (single version of the truth)

Save Time & Money

Naturally fast: Point and Click takes less time than data entry

Automation: Machine Learning systematically reduces the manual labour involved and ultimately

results in Straight Through Processing (STP)

Future Proof: The straightforward integration and modular flexibility facilitate the reutilization of processing

logic for various technologies like blockchain, as well as potential new products emerging from

new technologies.

Process standardization, optimization and improvements

Process standardization, optimization and improvements: enabling the establishment of bank operations in a new market in under 2 weeks. Optimizing processes propels banks towards more streamlined

operations, integrated systems and effective use of data

Building blocks

Issued Undertakings

Perform multiple Issued Undertaking events such as Issuance, Amendment and Claim Received, and retrieve corresponding details

Received Undertakings

Perform multiple Received Undertaking events such as Issuance, Amendment and Document Presented, and retrieve corresponding details

Outward Documentary Collections

Perform multiple Outward Documentary Collection events such as Create and Amendment, and retrieve corresponding details

Export Letter Of Credit

Perform multiple Export Letter of Credit events such as Advise, Amendment and Documents Presentation, and retrieve corresponding details

Import Letter Of Credit

Perform multiple Import Letter of Credit events such as Issuance, Amendment and Claim Received, and retrieve corresponding details