The only way is Cloud Solutions

Cloud computing in banking is an opportunity like no other. It enables banks to run a more cost-efficient operating model while providing the agility and modernity that legacy on premise models lack.

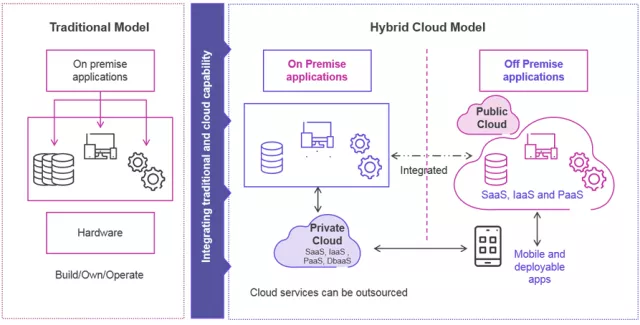

With cloud technology providers and vendors offering a choice of deployments – public, private and hybrid cloud – there are now many new options for banking infrastructure.

This is happening at a time when a major shift is taking place. With all banks focused on maximizing operational efficiency, the entire financial services industry is re-inventing itself to be faster, smarter and easier to use. Cloud computing is increasingly seen as the route to achieving this.

Here, you’ll find answers to some of the important questions around this fast-developing technology:

- What does the uptake of cloud banking look like?

- What challenges are banks facing?

- What is driving adoption and why?

- How fast are banks adopting?

Cloud Banking - Innovation without limits report

A worldwide survey of banking leaders carried out in partnership with EFMA provides a clearer picture of the needs and motivations for banks, what the cloud offers and some candid advice to those on a mission to move to the cloud.

Solutions

What is the appetite for cloud banking?

Where in the world do you see the most interest and take up on cloud?

Cloud deployment success factors

Agile deployment

Agile future

Quicker adoption

Clear ROI

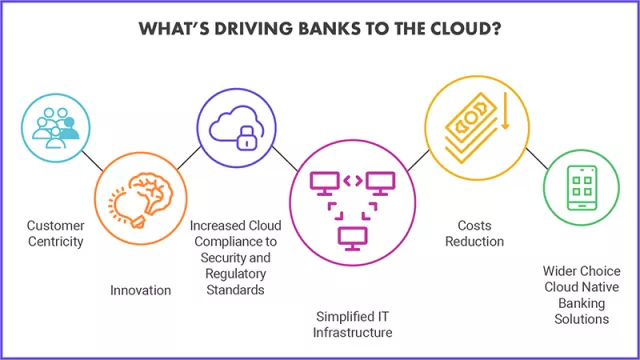

What's driving banks to the cloud?

Cloud adoption is rising faster than expected. The global financial computing market will grow to $299.4bn in 2020. And it will continue to grow at 17%. (Forrester; Gartner, 2020). The need to innovate, simplify IT Infrastructure, accelerate time to market and meet consumer expectations is pushing banks to look for innovative digital banking solutions that can be deployed quickly and efficiently.

A new era of disruption - open banking gathering pace

Open Banking and regulations worldwide are accelerating industry disruption to new levels. Challengers are building market share as consumers increasingly bank with multiple providers. On the cloud, banks have easy access to platforms and can quickly build ecosystems. With Finastra’s cloud platform, banks can take advantage of open platform capabilities and a growing suite of REST APIs to access a rapidly expanding ecosystem and to innovate and collaborate in a digital marketplace.

What does success in the cloud look like

Cloud is a key enabler of digital transformation. As well as boosting the capacity to handle data, it is about providing business agility and security, and enabling rapid evolution with on-demand innovation to satisfy growing business needs. The new breed of banks are reshaping the way customer interact with banking. More than 50% of customers now multi-bank. It is predicted that by 2027, 27 million customers will be served by the top nine European neobanks. And as regulators lower barriers to entry, the penetration of neobanks increases.

Driving banks to the cloud

A major shift is taking place in how enterprises select their financial solutions, with a migration to cloud applications happening faster than expected.

Today is essential that Banks can respond quickly to changing market conditions. Using the cloud brings agility, and the ability to deploy solutions that can evolve with the pace of growth.

Migration to the cloud is the ideal moment for banks to modernize their IT ecosystem.

The only way is Cloud (Infographic)

The Cloud is presenting an unprecedented opportunity to run with a more cost-efficient operating model while simultaneously providing the agility and modernity legacy, on-premise models lack.

More Information

Benefits of the Cloud in Banking

Cloud gives significant and enduring 'undercover' competitive advantage for banks that adopt it. But do Banks need to update more than just their software to achieve this?

What are the competitive advantages for hosting on the cloud?

Richard Peers provides his insight on how cloud enables banks to deliver best in class customer experience.

OPEN BANKING GATHERING PACE

Only 26% of banks feel ready for Open Banking

Clearer guidelines form regulators accelerates cloud adoption, and allows banks to increasingly focus on creating and enabling a new ecosystem that unites and integrate customers, digital and product-centric models as a single entity.

Platform makes possible previously unachievable level of service, collaboration and innovation. Combined with core solutions that have an open architecture and open APIs, it enables the quick extension of a bank’s ecosystem, providing new opportunities for revenue growth.

Fusion Essence in the cloud is a fully integrated core and digital solution, localized for the UK market. Deployed on Azure, Microsoft’s enterprise-ready, trusted cloud platform, it is particularly suited to ambitious challenger banks, enabling them to come to market with velocity, allowing them to launch personalized offerings first and fast, maintaining a competitive edge.

Check Out More

FusionFabric.cloud: Unlocking innovation in Financial Services

Watch Finastra CMO, Martin Haering, explain how the model for banking innovation is changing, and how FusionFabric.cloud can help build the future of financial services through open collaboration.

Build the future, today.

Learn how Firms can deliver innovative applications quickly and at low cost, transforming their own operations and development centers. FusionFabric.cloud will help transform the financial services industry in the same way that mobile app stores have transformed our everyday lives.

Build the future, today.

Learn how Firms can deliver innovative applications quickly and at low cost, transforming their own operations and development centers. FusionFabric.cloud will help transform the financial services industry in the same way that mobile app stores have transformed our everyday lives.

Where does cloud adoption leave traditional banks and how should they respond?

We asked senior executives what they had to say about cloud adoption and its benefits.

Interview with Jamie Devlin of Revolut for Business

Interview with Dennis Khoo of UOB Singapore

Interview with Jordi Amoros of Banco Sabadell

Interview with Mark Petersen of Danske Bank

Interview with Vlastimir Vukovic of NLB Bank Belgrade

Success in the Cloud

Banks today need to be able to compete and grow where margins are thin, competition is fierce and regulations are changing. Incumbents must embrace digital so they can anticipate consumer needs and innovate in ways that will prioritize the most effective mix of capabilities. This way, they can stay relevant with a lower-cost operating model.

Neobanks or challenger banks have the customer at the heart of everything they do, building their offers around customer needs. This contrast with traditional high-street banks that have developed in a product-centric way that lacks flexibility.

Mary Connor - Director for Retail Banking Product Management - provides insight into how “Partnerships between neobanks and large financial institutions can benefit both parties.” Find out more in this insightful piece.

Fusion Essence in the cloud

With a pay-as-you-go subscription model, Fusion Essence in the cloud frees banks from the burden of IT operations. The solution covers UK core and digital banking requirements including lending, digitally originated deposits, payments and regulatory reporting. An accelerated onboarding approach enables banks to launch first and, importantly, to drive fast customer adoption and business growth once live.

Go Big or Go Hybrid

Particularly for existing banks, a hybrid approach is increasingly seen as a sensible step towards a cloud-based future.

Do you want to learn more about our solutions?