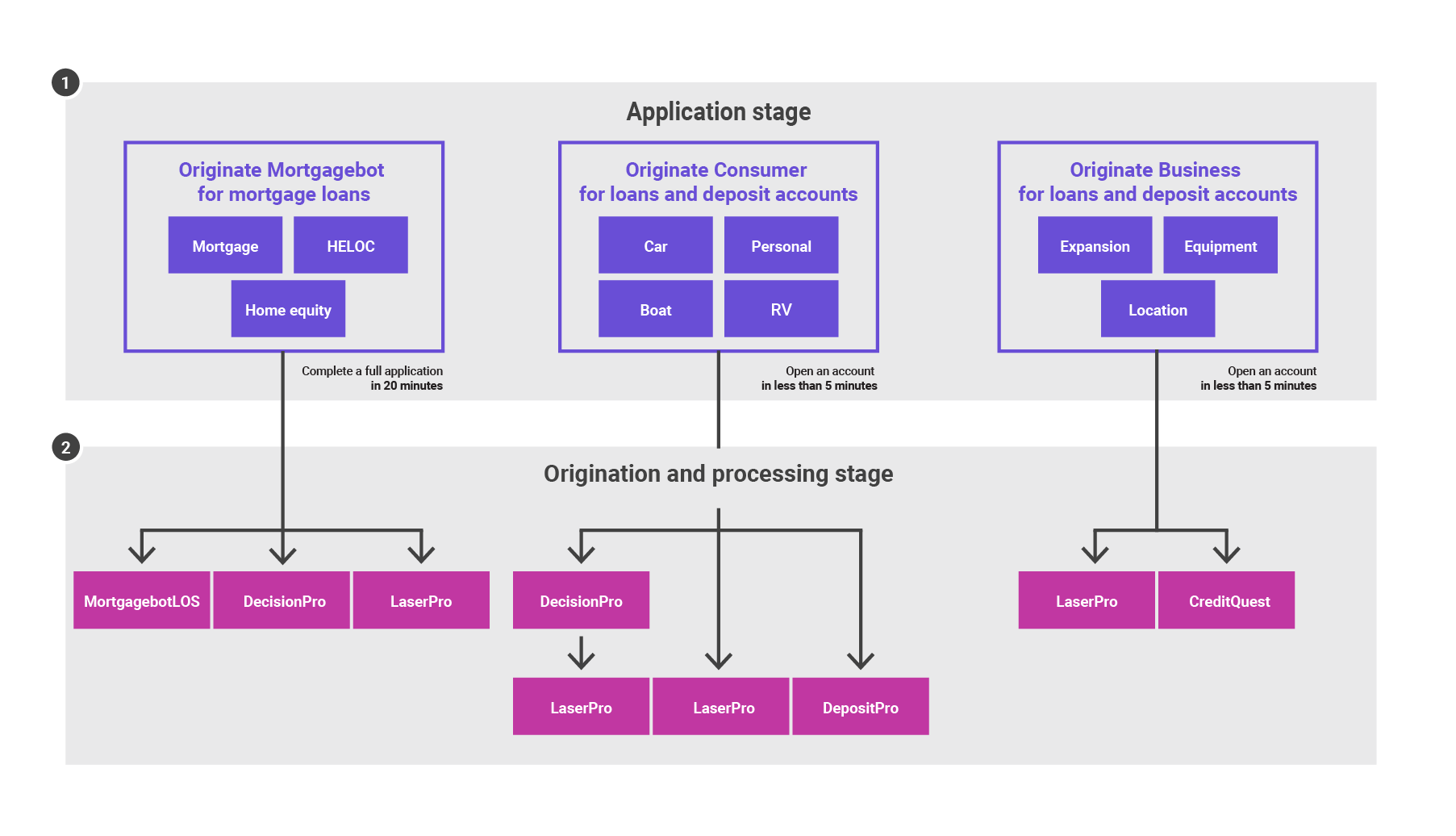

Originate: your all-in-one partner for seamless and compliant origination and processing

Highly configurable, Originate offers a personalized user experience tailored to match your institution’s branding and product requirements for residential mortgages, consumer and business loans, and deposit accounts. Benefit from seamless integration with Finastra’s processing solutions as well as other third-party LOS systems, reducing time to close

Find out more Speak with us today

Seamless integration with Finastra’s LOS solutions (see list below), as

well as integrations to third-party core banking solutions and other LOS

systems via API. This allows you to easily connect to your own system

architecture.

Our solutions are highly configurable and white-labeled, tailored to

meet the specific branding and styles of your financial institution. Any

application is responsive in nature, enabling the seamless completion of

the application on any device.

Originate Mortgagebot

The personalized and responsive omni-channel POS guides the applicant through the digital mortgage application and allows financial institutions to collect a full URLA in a streamlined and compliant manner. The robust product offering supports:

- Mortgages for purchase, refi, home equity, HELOCs and construction loans withing parameters

- Support for fixed and adjustable interest rates; monthly, interestonly & bi-weekly payment options; and 30/360 & 365/365 accrual methods

Present applicants with personalized product and pricing offers, along with required disclosures. This provides transparency and an enhanced experience while ensuring compliance.

Provide instant pre-approvals/provisional decisions through Fannie Mae’s Desktop Underwriter, Freddie Mac’s Loan Product Advisor, or the highly-configurable, built-in tool called PowerApprove. For more complex cases, the applicant is notified that the lender is reviewing the file.

Borrowers are provided a personalized list of documents that must be provided for their loan application and given a way to securely upload the documents to the lender.

Consumer and Business loans and deposits

The combo application makes it easier to apply for a consumer or business loan, and open a deposit account in the same application.

Originate has two major elements:

Robust administration tool for managing the entire lifecycle of the application process using the Admin Console.

Expanding capabilities to the deposit account opening process, which includes Trust accounts and UTMA (minor) accounts, too

* The Funding solution is integrated with Plaid for their account verification and balance service, and with Allied Payments for their ACH transfer solution

Fraud improvements:

Originate Consumer

Fraud improvements: Originate Consumer is integrated with Equifax for

the DIT (identity trust) and Secure MFA solution for their IDV

(identity verification) /IDA (identity authentication) solution.

*Originate Consumer supports 15+ core

integrations including Phoenix, FIS, Fiserv, Jack Henry

Fraud improvements: Originate Business

Fraud improvements: Originate Business integrated with FIS Biz Chex,

which performs IDV and IDA on the business. It allows up to 5 owners

or authorized signers per account.

*Originate Business is integrated with

Finastra’s Phoenix solution, and with Jack Henry

Our Originate solutions geared to support your growth

Solutions

Level-up your LaserPro - Add-ons to turbocharge your document management.

Unlock powerful origination with our solutions today