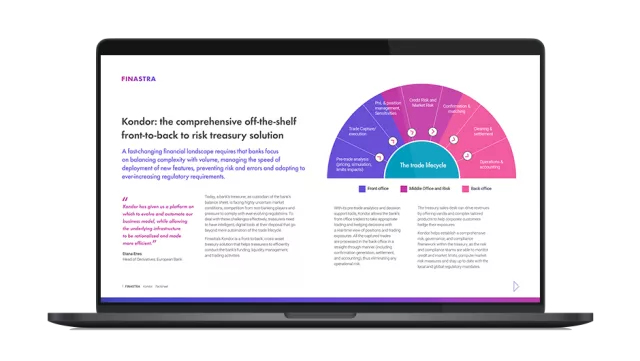

Finastra Kondor Solution Overview

Kondor offers powerful risk analytics, trade processing, position management, real-time risk coverage and more.

As a best of breed trading system, it enables banks to trade high volumes in treasury while offering the flexibility to support more complex derivatives, options and structured trades.

Benefits for Banks

Increase in treasury transactions

Increase in the number of trades

Faster time to market for new products

Growth in customer-driven transactions

Key features

Powerful risk analytics and position management

Real-time coverage of credit, market and liquidity risk

Full back-office processing

Full support for trade processing, including deal validation, payment settlement and accounting

Extendable and adaptable through access to Finastra’s FusionFabric.cloud platform

Meeting financial institutions’ needs for more sophisticated treasury solutions

Lifting the veil on Trading Book Counterparty Credit Risk Measures

Leveraging Testing-as-a-Service to unlock Summit's full potential

CloudMargin

CloudMargin is owned by key market stakeholders including key infrastructure providers and dealer banks. It provides an end-to-end collateral management solution covering Variations and Initial Margin workflows, CSA, GMRA and GMSLA agreements, Bilateral and Triparty, Cleared and Uncleared transactions. All of this supported by a flexible reporting and scalable cloud-native technology.

Say yes to the best of breed trading system