Plotting a route towards efficient and automated loan servicing for high-volume bilateral lending

Financial institutions lending to small and medium enterprises (SMEs) recognize that while demand for business loans is on the rise, challenges such as competition from new market entrants, understanding their bilateral loan servicing needs, and changing customer expectations, are growing too.

According to the Federal Reserve Banks' Small Business Credit Survey, 43% of small businesses in the U.S. applied for loans in the past year [1]. Looking to Europe, a report by the Office for National Statistics (ONS) suggests 48% of UK small businesses are looking to lenders to help fund their expansion in 2025 [2].

Enter Simplified Servicing

To help banks effectively manage their SME and commercial lending workflows, Finastra has developed a thin client user interface on top of Loan IQ, named Simplified Servicing. With intuitive interactions and fast pathways built on built on top of Loan IQ’s proven lending platform, Simplified Servicing is dedicated to the servicing of high-volume, bilateral or SME loan portfolios.

To ensure that Finastra was building a solution that met the needs of its clients and the market, Finastra conducted peer reviews with leading financial institutions around the world to gather their views on how they service these loans today and identify opportunities for Finastra’s product roadmap and developments.

The reviews were crucial in prioritizing client and user requirements, ensuring a seamless user experience and interface.

A recap on Loan IQ

Finastra Loan IQ is a comprehensive loan servicing platform that optimizes and automates commercial lending, from complex syndicated loans to high-volume bilateral loans. Loan IQ with Simplified Servicing and Nexus enables banks to have a robust servicing solution that fits into their digital end-to-end lending journey with ease, meeting current needs and supporting future growth strategies.

The result: Five key themes identified

The peer review highlighted five key themes related to servicing high volume bilateral loan transactions. In combination, they reveal demand for a streamlined, efficient, and customizable user interface and experience in Loan IQ to improve productivity and satisfaction.

- Streamlined onboarding to reduce time to funding: reduce input time, improve workflow, minimize errors, eliminate rekeying, and simplify origination output.

- Simplified user experience and interface to boost efficiency: streamline high volume transactions, add error-reducing guardrails and create intuitive steps for users.

- Collateral management to create compliant and centralized collateral monitoring: avoid using multiple systems for collateral management that can cause data inconsistencies, errors and delays.

- Workload distribution to improve visibility and customizable work in progress: deliver better visibility and reporting to reduce risk, while improving user satisfaction.

- Mass data processing to save time, reduce IT involvement, and empower users: support a user-friendly interface for mass data updates to improve accuracy and enhance flexibility.

Which users do we design Simplified Servicing for?

As part of the review process, we validated Loan IQ user personas, discussed operational team structures for bilateral loans, and acknowledged varying job titles and organizational structures. These personas will guide our user interface and experience design for Loan IQ Simplified Servicing.

| Persona | Role | Responsibilities | Focus | Impact |

| Loan operations manager | Manages work queues and distributes tasks | Ensures efficient workflow and task allocation | Optimizes team performance and workload balance | Enhances operational efficiency and team productivity |

| Deal setup specialist | Sets up deals, facilities and collateral for new loan bookings | Ensures accurate and timely setup of loan-related transactions | Detail-oriented, proficient in Loan IQ, strong organizational skills | Critical to the smooth initiation of new loans and maintaining data integrity |

| Servicing specialist | Processes high volumes of bilateral servicing transactions | Supports frontline teams and clients with transaction processing | Efficient, detail-oriented, strong multitasking abilities | Ensures smooth and accurate servicing of loans, enhancing client satisfaction |

| Quality assurance checker | Reviews, approves, and releases transactions | Ensures accuracy and compliance of transactions made by others | Detail-oriented, strong analytical skills, thorough understanding of loan processes | Maintains high standards of accuracy and reliability in loan servicing |

Summarized opportunities and potential user experience improvements

Finally, matching the personas with their requirements, we identified the opportunities to improve their user experience, and how Simplified Servicing would meet this need.

| Persona(s) | Requirements for each lending persona | Simplified Servicing user experience |

| Loan operations manager | 1. Real-time dashboard: Implement a dashboard with real-time data and visuals. 2. Report management: Simplify exporting, sorting, and filtering of user’s work queues and scheduled activity reports. 3. Approval process: Streamline the approval process with better controls. 4. Customizable Suspicious Activity Report (SAR): Make SAR reports more user-friendly and customizable. 5. WIP management: Add functionality to clear old items from WIP. 6. Advanced search: Enhance search capabilities by RID and loan alias. | Users will feel more empowered, efficient, and satisfied, experiencing reduced stress and frustration, and enjoying a more productive and positive workflow |

| Deal setup specialist Quality assurance checker | 1. Simplified navigation: Make navigation more intuitive. 2. Field integration: Ensure seamless field flow between notebooks. 3. Amendment processing: Simplify amendment processing. 4. Data sheet & quality control: Add a boarding data sheet and quality control features. 5. AI/OCR Integration: Use AI/OCR for reading credit agreements. 6. Reduce rekeying: Minimize rekeying of information. 7. Error reduction: Implement measures to reduce errors. 8. Streamlined interface: Reduce layers/screens for loan boarding | Users will feel confident, efficient, and satisfied, experiencing reduced frustration, and enjoying a smoother onboarding process |

| Servicing specialist Quality assurance checker | 1. Outstandings view: Show only outstanding level or level that is needed (Deal/FAC/OST). 2. Simplified repricing: Make repricing easier. 3. Notebook integration: Merge multiple notebooks into a single view. 4. Quality assurance: Add a checker feature. 5. Participation processing: Simplify participations. 6. Streamlined transactions: Simplify steps for transactions to reduce errors in high-volume transactions. (payments, advances, loan repricings, payoffs, payoff statements). | Users will feel more confident, efficient, and satisfied Users will experience reduced stress and frustration, and enjoy a more streamlined, accurate, and productive servicing process User experience will be enhanced by simplifying processes, improving efficiency, and reducing risk. |

Unboxing Simplified Servicing

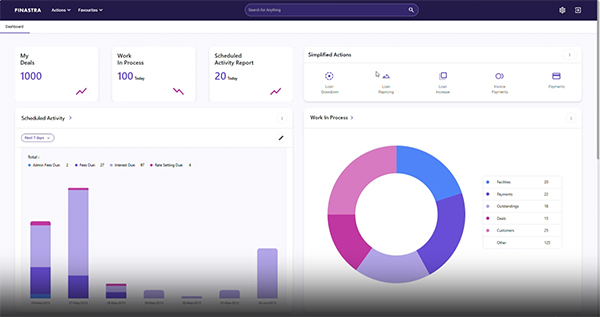

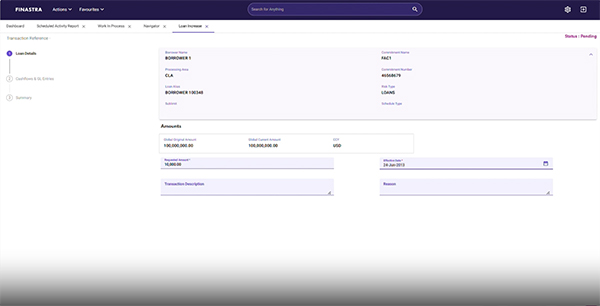

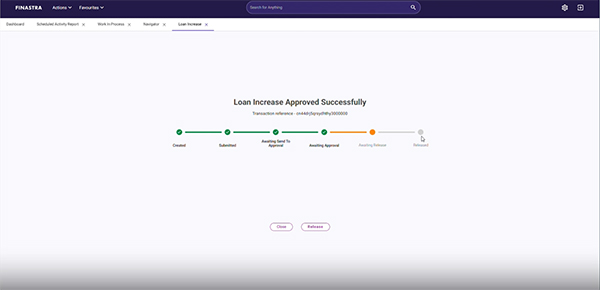

Loan IQ Simplified Servicing was designed with the end user in mind and the thin client user interface embodies the modern look and feel of the user experience:

The possibilities of innovation

As we continue to innovate and explore the possibilities of Generative AI (Gen AI) in Simplified Servicing, we are committed to integrating cutting-edge technologies to support your business needs. Simplified Servicing is designed to be an innovative platform that will evolve with advancements in AI. While the lending market continues to evolve, Finastra remains dedicated to enhancing Loan IQ Simplified Servicing to ensure that banks remain as competitive as possible when dealing with their SME customers.

To learn how you could simplify your loan servicing with Loan IQ, contact us today.

Visit the Loan IQ Simplified Servicing solution page.

1 Small Business Loan Statistics And Trends 2025 – Forbes Advisor

2 How Technology Supports SME Lending | FullCircl