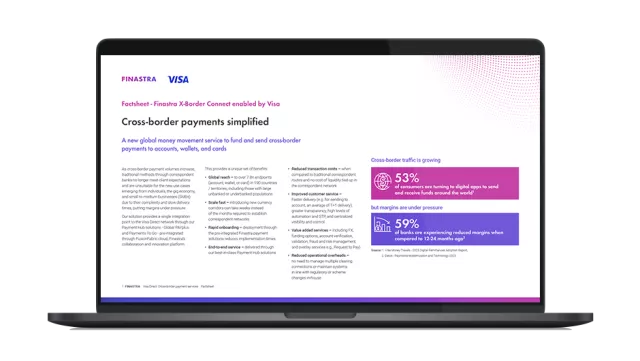

Finastra X-Border Connect enabled by Visa

Cross-border payment volumes are increasing but use of traditional correspondent networks can result in high friction and cost, and a lack of transparency over payment status and charges. In partnership with Visa, Finastra is providing a new global money movement service to fund and send cross-border payments to accounts, wallets, and cards.

Traditional cross-border payment methods are no longer able to meet client expectations and are unsuitable for the new use cases emerging from individuals, the gig economy, and small to medium businesses (SMBs) due to their complexity and slow delivery times, putting margins under pressure. A new solution from Finastra and Visa provides a single integration point to the Visa Direct network through our Payment Hub solutions - Global PAYplus and Payments To Go - pre-integrated through FusionFabric.cloud, Finastra’s collaboration and innovation platform.

In this factsheet we consider:

- the benefits of the solution such as global reach, rapid onboarding, reduced transaction costs, and improved customer service

- key features and business use cases supported including remittances, the gig economy and marketplace sellers, and funds disbursements

- a comparison of the services offered by the solution for account, card, and wallet transfers.