Realizing the promise of the new age of payments in the US

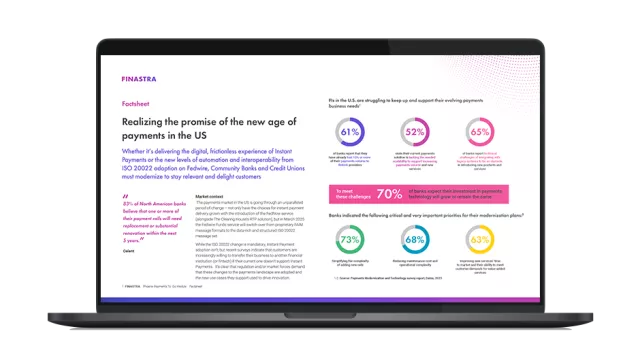

Whether it’s delivering the digital, frictionless experience of Instant Payments or the new levels of automation and interoperability from ISO 20022 adoption on Fedwire, Community Banks and Credit Unions must modernize to stay relevant and delight customers

The payments market in the US is going through an unparalleled period of change – not only have the choices for instant payment delivery grown with the introduction of the FedNow service (alongside The Clearing House’s RTP solution), but in March 2025 the Fedwire Funds service will switch over from proprietary FAIM message formats to the data-rich and structured ISO 20022 message set.

Finastra is providing a pre-integrated solution combining Fusion Digital (for payment initiation and tracking), Finastra Payments To Go (our Payments-as-a-Service (PaaS) hub), Fusion Phoenix (for Core banking), and our partner fintech ecosystem for additional services (such as compliance, AML, and fraud management) specifically suited to US mid-market financial institutions, such as Community Banks and Credit Unions.

In this factsheet we consider:

- the market context and challenges

- the case for adopting a PaaS solution

- the business architecture, key features and benefits of our solution

- the wide range of new use cases available to elevate the customer experience