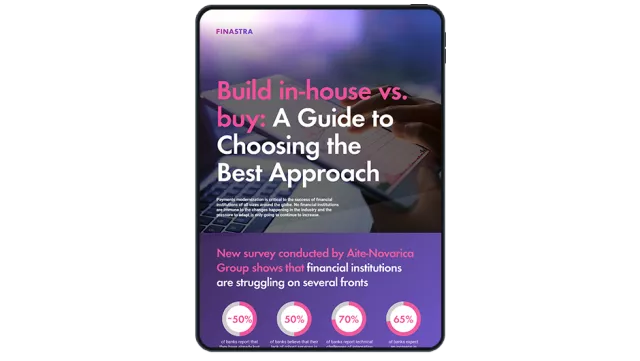

Build in-house vs. buy: A guide to choosing the best approach

Payments modernization is critical to the success of financial institutions of all sizes around the globe. No financial institutions are immune to the changes happening in the industry; but what factors govern the decision to build in house or buy?

The need to modernize is driving substantial investment growth by financial institutions across a wide range of asset sizes and geographies with 76% of banks expecting their investment in payments technology to grow or remain the same. With:

- 70% of banks reporting that the technical challenges of integrating with legacy systems are an obstacle in introducing new products and services

- 50% of banks reporting that they have already lost 10% or more of their payments volume to fintech providers

the pressure to take action is clear.

An important decision is whether to develop new capabilities in-house or choose a vendor product.

This infographic considers the pros and cons of both approaches and shows that in many cases partnering with a vendor to deliver a payment hub is the most cost-effective and future-proof solution.