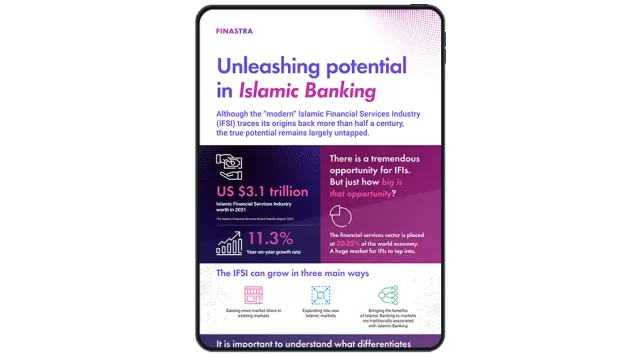

Unleashing potential in Islamic banking (Infographic)

The Islamic Financial Services Industry (IFSI) is relatively young, but certainly not small. In 2021 the industry was worth an estimated US $3.1 trillion. There is clearly tremendous room for growth.

Financial services is technology-driven and so too, is the IFSI.

While technology is rapidly transforming financial services all over the world, its impact on the IFSI has been less pronounced. Why?

What is holding the industry back?”

To cater for the intricacies of the Islamic Financial Services Industry, many banks that operate both conventional and Islamic banking businesses have had to deploy two core banking systems. One system for their Islamic banking business and another for their conventional banking business. This increases costs and risks, while limiting agility and hampering the delivery of differentiated customer experiences.

For the Islamic banking business, the majority of systems’ providers seem to have gotten it wrong. Many misunderstood, the business and operating models, creating sub-optimal banking platforms.

So how do legacy technologies create problems, what is the challenge of running two core banking systems and how can it be solved? Read more here.