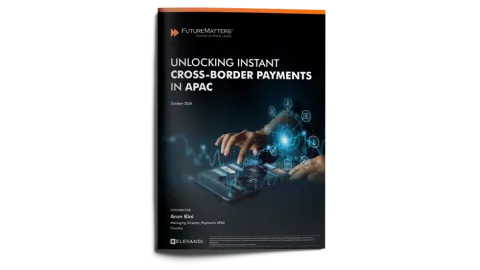

Unlocking instant cross-border payments in APAC

While demand for instant cross-border payments is growing rapidly in Asia Pacific, many banks have been slow to adapt to the changing landscape, not least because of the limitations of legacy systems. To compete effectively in this landscape, banks need to embrace modern payment systems that will enable them to stay ahead of the changes driven by agile fintechs and regulatory institutions.

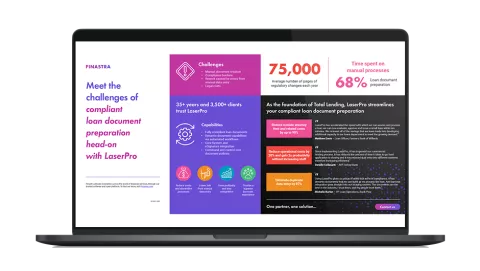

Default Finastra

Demand for cross-border payments is continuing to rise across Asia Pacific, and particularly in ASEAN. As corporates expand their manufacturing centres in markets like Vietnam, Cambodia, Indonesia and Thailand, there is a growing need for cross-border payments to suppliers in these countries. At the same time, markets like Vietnam and Cambodia have leapfrogged from a cash culture straight into the digital era, with the rise of ecommerce continuing to drive higher volumes of cross-border transactions.