IntelliBonds

IntelliBonds is an AI-augmented platform delivering Alpha generation and cost optimization to fixed income investors.

About this app

Description IntelliBonds helps institutional investors lower costs through intelligent automation whilst transforming data into alpha. Our virtual AI assistants ‘collaborate’ with your investment professionals, allowing them to save time and improve decision-making.

Key Benefits:

- Superior returns

- Avoid forced selling

- Cost reduction

- Early warning system

Portfolio optimizer - You can optimize your account or deploy cash, construct a portfolio from a universe of bonds (or benchmarks) by choosing an objective (maximize and minimize tracking error) and setting various constraints like turnover limit, transaction cost budget, rating limits, sector constraints, and issuer limits. Easily express your credit views on sector, rating and maturity buckets as constraints and create constraints to meet ever growing challenges in the area of ESG and regulation.

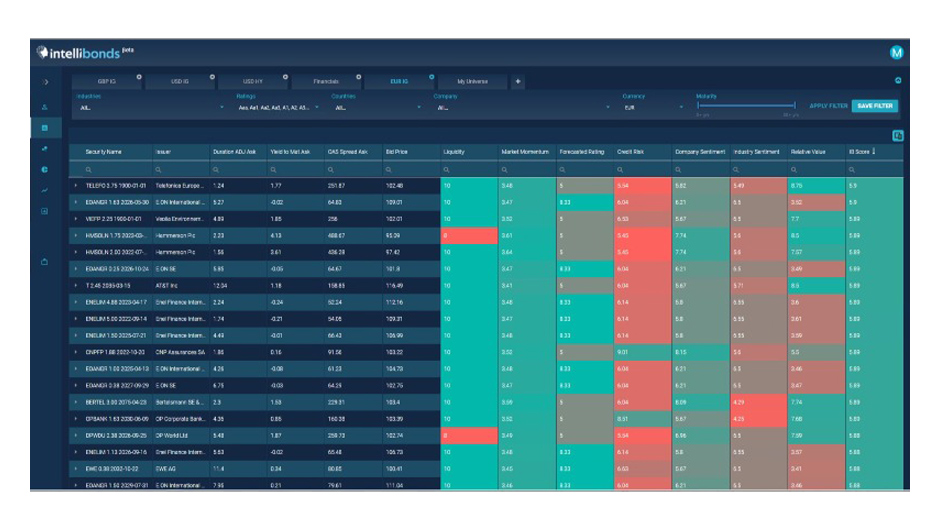

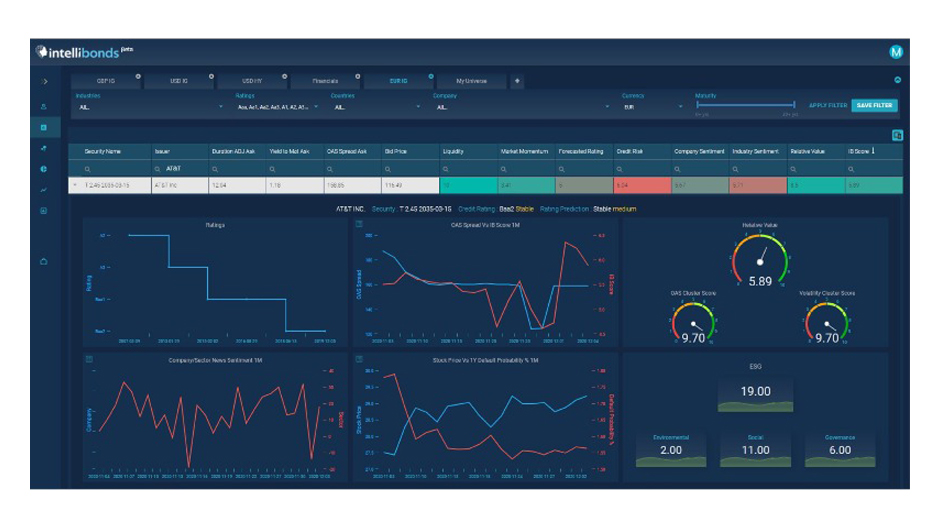

Portfolio analysis & Monitoring section - Deep dive on your portfolio, see where the value is coming from or where there is a lack of performance by slicing and dicing, custom charts, and past trading decisions. Algorithms will continuously alert you about issuers that are predicted to see a material spread change or are at the risk of downgrade or default in the portfolio. Simply delve into the details of a particular issuer or bond by visiting the credit analytics page.

Building blocks

FX Rates

Fetch the foreign exchange rates maintained by the bank for the requested currency pair and retrieve the equivalent FX amount

Forex Swap Trade Capture

Insert (Create) a Forex Swap trade executed and cleared on Trade Platform into the core system acting as the trade repository