Rapid Fin Pay for Corporate

Providing easy and intuitive access to business to initiate domestic and international wires.

About this app

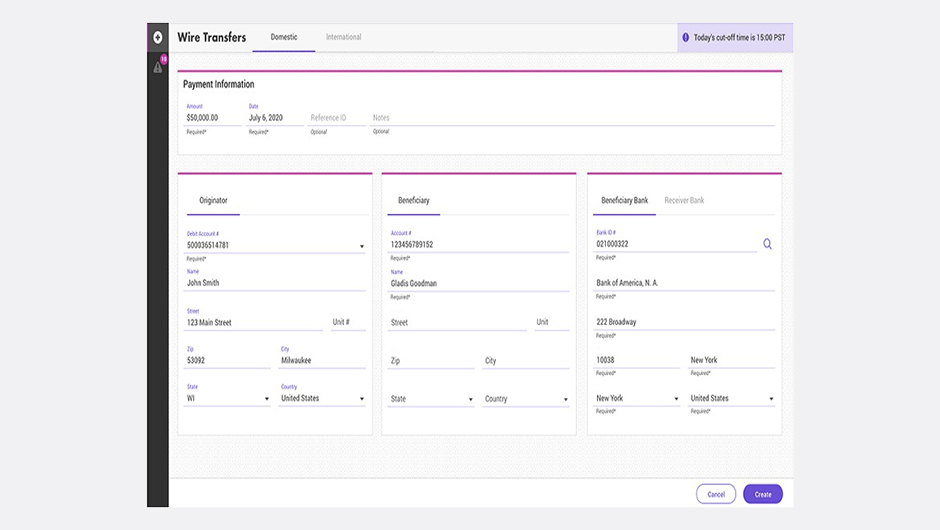

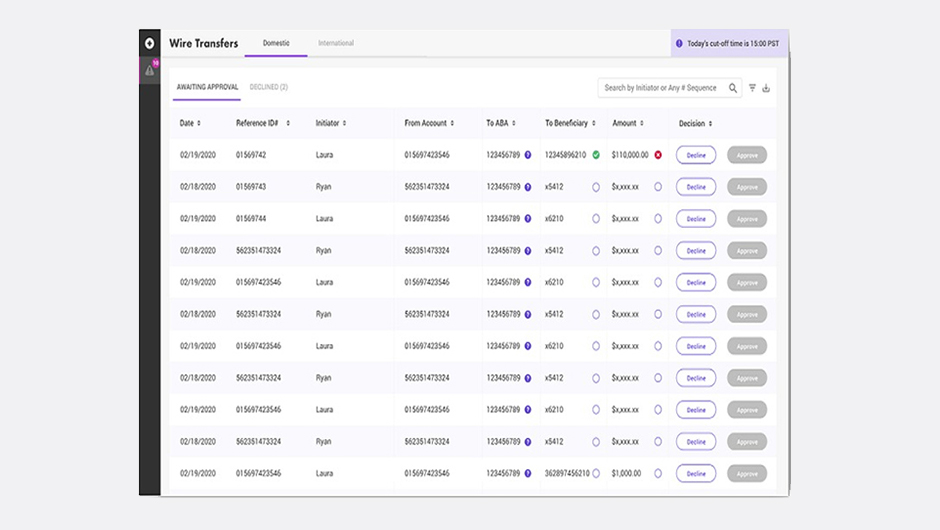

Fusion Rapid Fin Pay provides a payment initiation facility to the small medium business (SMB) customers of the Financial Institution, with the ability to initiate US domestic wires via web browser. The application supports a maker and a checker persona.

Financial Institutions need to deliver solutions that take advantage of market changes (e.g., new rails, Open Banking and ISO20022 adoption) beyond simple compliance and hence deliver better customer service. Customers (including SMBs) are increasingly demanding an improved digital experience with high levels of automation and self-service along with increasing expectations of transparency, speed, and optimized clearing and settlement. The pressure to deliver compelling use cases that differentiate from the competition drives the need to be part of the platform economy and work collaboratively with Fintechs to deliver innovation.

Right sized solution

The solution is based upon our unique understanding of the requirement (having supplied GFX web) and it is designed to deliver the necessary functionality without the complication and expense of a full DC/Cash Management solution. In addition, we have an excellent insight into the future needs of this client base and so have designed a responsive roadmap.

Digital experience

The solution is web based (doesn’t required installation on customer side) highly secured (use of Oauth standards for authentication) and quick to implement. The solution ensures high levels of automation and STP by extensive validation of the payment at entry (e.g., all mandatory fields present, valid business date and routing numbers) and reduces operational effort and risk (only required fields are entered, optional re-keying by the checker). Fusion Rapid Fin Pay provides a much-improved user experience over the legacy GFX web solution.

Extensible via FusionFabric.cloud

The solution is delivered via integration with FusionFabric.cloud, Finastra’s open collaboration platform – as a result we can deliver value added Services through the offerings of other players on the platform – for example AI/ML based fraud detection and the provision of preferential FX rates (enhancing the international non-USD payment initiation offering)

Building blocks

Payment Following Raw ISO20022

Initiate, modify or cancel a new Customer Payment based on ISO20022 and perform pre-initiation calculations such as currency conversion rates

Financial Institution Identifications

Retrieve information of national financial institutions or banks identification codes

Corporate User Profile

Get the list of features and details accessible to the logged-in user, based on privileges granted

Accounts and Balances

Retrieve the list of an authenticated user's corporate accounts and also retrieve the individual account details, balances and statement.

Transaction Approvals

API to approve or reject a particular transaction pending for approval as per corporate's authorization workflow

IBAN Services

Validate, deconstruct and retrieve the bank details for an IBAN account number