RoboSave

Increase deposits and user engagement through automated savings

About this app

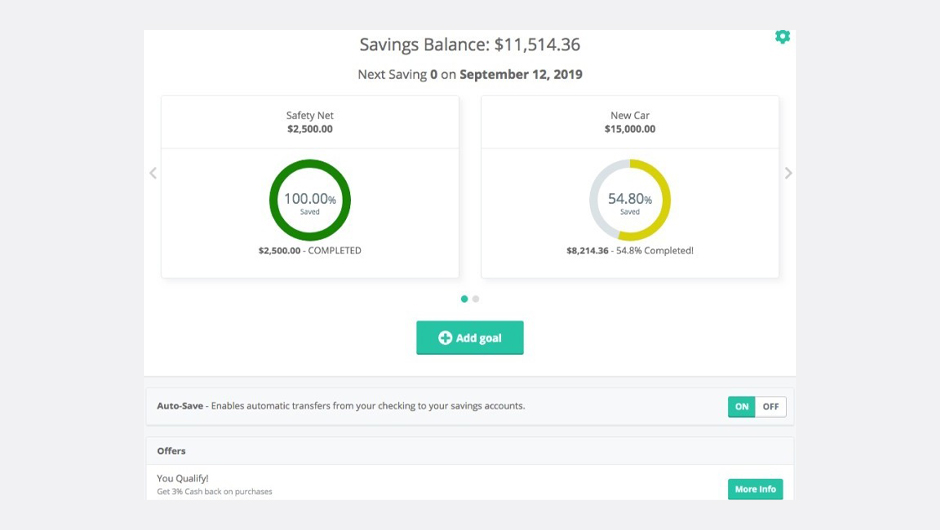

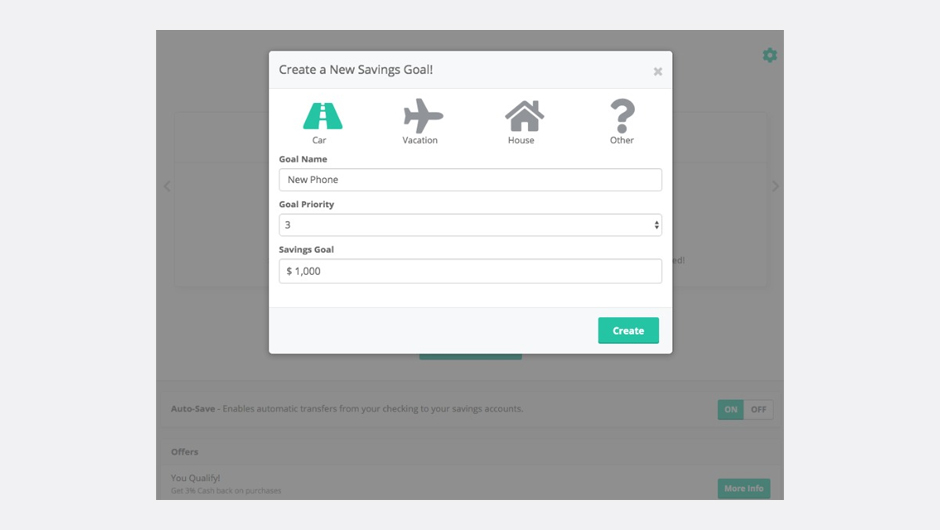

RoboSave helps your account holders save money to increase their individual financial stability. The platform analyzes the account holder’s transaction history to create a personalized safety net for each user, then determines how much money they can save every couple of days, and automatically transfers that money out of the user’s checking account and into their savings.

Community Banks and Credit Unions are seeking to engage and dominate younger markets. Millennials and Gen Z are becoming more aware of third-party options, eager to acquire the knowledge and skills needed to make important financial decisions; therefore, are willing to try new money saving tools.

It is crucial for Financial Institutions to get useful analytics to better and more accurately determine when a customer qualifies for a product, so that they can propose adequate saving solution. Unlike Monotto’s competitors, Robosave helps the Financial Institutions keep the funds within the company instead of sending them to a 3rd party.

Compelling vs Disintermediation

Protect deposit accounts by offering an integrated product alternative to the many offerings provided by Fintechs. Savings accounts are created and maintained within the financial institution fighting back against disintermediation of 3rd party applications.

Affordable response to young account holder needs

Small Banks & Credit Unions have discovered that providing the assistance younger generations require is expensive, difficult to maintain and hard for community financial institutions to deploy. Immediately increase deposit shares and educate users on savings practices through an AI based, fully integrated solution that suits the young person’s lifestyle.

Effective Data Analysis for product opportunities

By keeping the funds within the Financial Institution, additional metrics can be gathered to augment current data, allowing for additional sales opportunities, and understanding of the institution's current customer base, as opposed to other automated saving solutions which typically do not expose the data and use it for 3rd party product offering.

Building blocks

Account Information (US)

Retrieve a list of accounts and transactions, obtain account and transaction images (e.g. Check Images or Deposit Images)

Internal Transfers

Post transfers between consumer accounts, retrieve transfer history or view transfer options

Consumer

Retrieve account holder data and Financial Institution account holders based on search criteria