How banks can lead towards commercial sustainability

The challenges and opportunities for ESG-related finance

Once seen as a niche market, interest in sustainable loans has risen 100-fold over the last ten years,i as businesses seek capital to meet shareholder and consumer demand for environmental accountability.

Across generations, consumers are now willing to spend more to support sustainability. The number of generation Z cohorts who are willing to pay more to purchase sustainable products increased 42% over the last 2 years, and 90% of generation X cohorts say they would also pay more to buy sustainable products.

Investors are also keen to base financial decisions on how well a company manages its environmental impacts. A recent report by EY reveals that 78% of investors want businesses to focus financial decisions on ESG matters, but only 55% of businesses are willing to do so.ii

While there are financial benefits to improving sustainability, it may take years for organizations to realize the gains, making it difficult to justify the costs associated with overhauling existing systems, processes and supply chains.

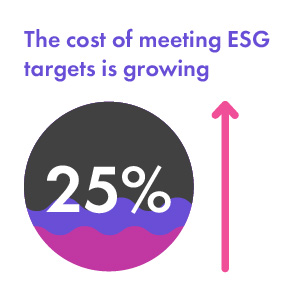

As the cost of meeting global ESG targets continues to rise, jumping 25% in 2022 alone,iii financial support is critical for businesses as they transition to sustainable practices. Increasing demand creates new opportunities for financial institutions, and while there is currently a lack of global regulations and standards, as the ESG financing industry develops, several region-specific best practice recommendations will be issued to guarantee the integrity and compliance of lender and borrower goals.

For example, when seeking guidance on which KPIs corporates should disclose as part of their ESG reporting, banks can consult with the Sustainability Accounting Standards Board (SASB), the Climate Disclosure Standard board (CDSB), and the Global Reporting Initiative (GRI) which provide ESG-related frameworks. As processes develop, the complex pricing structure for loans and spreads that already exists will become much more challenging to sustain and account for with the addition of ESG-related margins.

The need to understand and establish trackable metrics, as well as the challenge of gathering and assessing the vast amount of data required to determine green alignment, has banks seeking ecosystem environments, where all participants can seamlessly share information. Finastra is committed to supporting its clients’ needs to comply with these new regulations, by orchestrating and enabling integrations with software providers to bring streamlined new services and digitized automated workflows.

Leading towards sustainable lending

Financing approach and implications

Sustainable loans are generally offered in two forms. Green loans require the borrower to utilize 100% of the proceeds toward projects aimed at making a substantial contribution to an environmental objective. Sustainability-linked loans encourage organizations to improve sustainability by linking loan terms to predetermined sustainable performance targets.

For banks, the move toward sustainable finance is a seismic shift in the way financial institutions have historically operated. While traditional lending is based on review of past data, such as financial performance, assessing environmental risks and how likely an organization is to meet its sustainable goals, calls for forward-looking data.

Banks must understand current climate conditions and how they might evolve. Additionally, the institution must have visibility into how changes to the environment may impact entities by way of transitional and physical risks.

Need for common, clear and consistent standards

But who determines the metrics that define sustainable opportunities or the bank’s lending portfolio, and how will they be enforced? Standards often change from one geography to another.

For instance, the EU Taxonomy provides a classification system to help investors and policymakers define economic activities that are considered environmentally sustainable. While clear standards make it easier to identify green projects and investments, not everyone agrees on what constitutes a sustainable initiative. The EU Commission, for example, realizes that some nuclear and gas power projects may be ESG compatible, but the Spanish Government has a different perspective as to how aligned these projects are to their own society's ESG goals. This is a clear example of the different perspectives on the "sustainable credentials" of ESG related investments or initiatives.

Without clear standards for defining sustainable initiatives, banks may think that the fastest way to a sustainable portfolio is by removing pollutive assets. However, most experts agree that the world will be at least partially reliant on fossil fuels for some years to come. Banks could miss vital opportunities to finance change within these industries by excluding the so-called “brown” investments from their portfolios.

With 83% of companies who responded to a recent study saying that they plan to support the UN Sustainable Development Goals,iv banks will need a way to rapidly navigate changing regulations and guidelines to support finance sustainability.

Bringing participants together through technology

As banks traverse the complex arena of sustainable lending standards and regulations, technology becomes a key enabler. It makes sense to connect all participants into a singular "open" ecosystem in order to assess sustainable lending opportunities and the associated risks involved. Doing so enables a consistent and seamless flow of information from third-party resources across the bank, informing sustainable lending decisions as well as financial allocations at large.

For example, Green RWA (Risk-Weighted Assets) – a non-profit association, supporting and fostering banks’ green activities with climate financial risk modelling – supports banks in their journey toward Net Zero Emissions by 2050 through a 3-tiered approach. Green RWA computes climate-extended metrics required for reporting and disclosure and then assesses sustainability of net-zero transition scenarios of lending portfolios under non-stationary climate risk factors.

Green RWA is an extension of the CERM Credit Risk Model, and helps banks calculate credit losses and the probability of default based on climate-related metrics. However, achieving an accurate representation of risk requires a wide variety of data, such as distance of the property from the sea or average hours of sunlight in a particular region.

Data like this will help determine Key Performance Indicators (KPIs). KPIs are critical metrics that must be established and met, since they will drive pricing of sustainable lending products.

The smooth and efficient flow of information across stakeholders is essential, and open APIs are the best way to facilitate this. Through the use of APIs, banks can integrate multiple data sets across third parties, banks and fintechs, as well as enterprise risk management systems and other participants, onto a single platform. The seamless flow of information allows for the automation of risk assessments and the determination of suitable KPIs, allowing banks to appropriately price sustainable lending products and improve overall portfolio management.

By financially backing businesses in their efforts to achieve sustainable goals, banks are driving a greener future for all.

i “Global Green Finance Rises Over 100 Fold in the Past Decade-Study.” Reuters, Mar. 31, 2022. Web.

ii “Businesses and Investors at Odds Over Sustainability Efforts.” EY. EY, Mov. 11, 2022. Web.

iii Simon Jessop. “Cost to Hit U.N. Sustainability Goals Rises to $176 Trillion-Report.” Reuters, Sep. 8, 2022. Web.

iv “State of Progress: Business Contributions to the SDGs.” GRI. Retrieved from https://www.globalreporting.org/media/ab5lun0h/stg-gri-report-final.pdf.