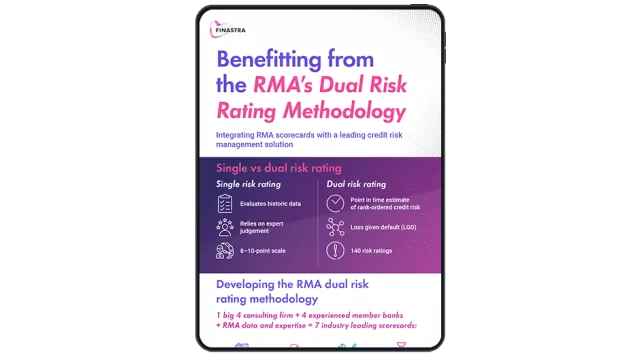

Harnessing the benefits of a dual risk rating methodology (Infographic)

Integrating RMA scorecards with a leading credit risk management solution streamlines loan origination from application to close.

If your bank is looking to move into a dual risk rating, it’s important to think about how it’s integrated into existing loan processes. To realize the best bang for your buck, integration with the existing loan credit and origination system is key. When you look at 140 different scales associated with the dual risk rating, it is overwhelming. What Finastra and RMA have done with CreditQuest is to simplify how the information is accessed, by streamlining the lending process from application to close. Read our latest whitepaper to find out more.