ISDA SIMM Solution

Calculating Sensitivities and Initial Margin under ISDA SIMM.

About this app

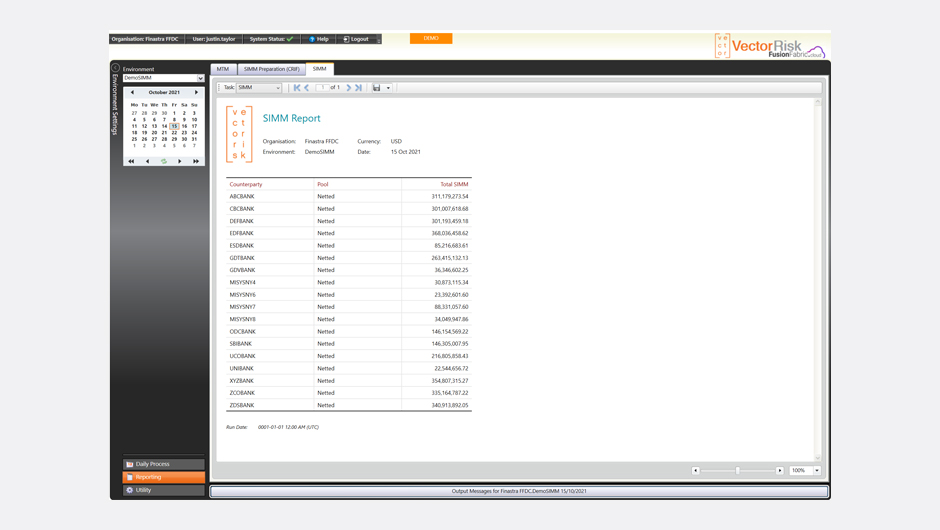

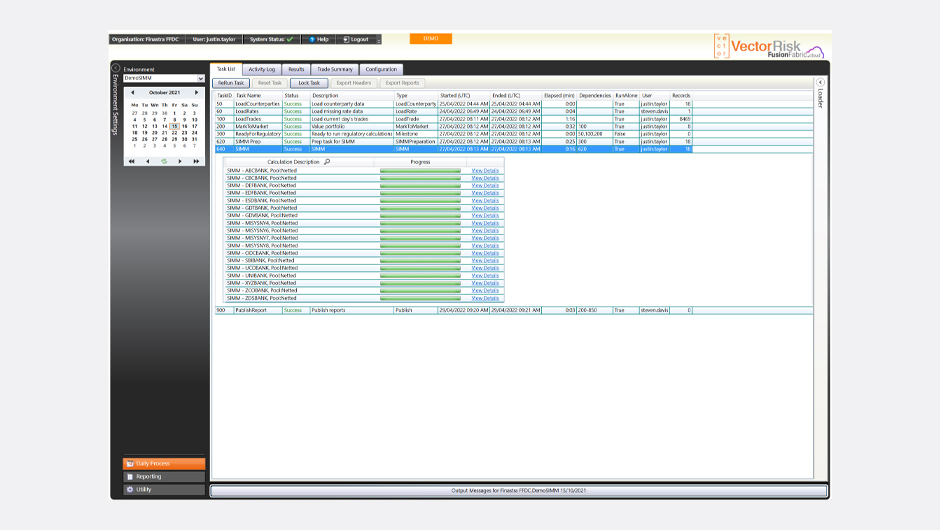

Vector Risk provides a multi-tenancy SaaS solution for SIMM. As a SaaS solution, Vector Risk dramatically reduces implementation timeframes, has little project risk, requires no new IT infrastructure, and provides regulatory evergreening.

The standard initial margin model (SIMM) is a common methodology to help market participants calculate initial margin on non-cleared derivatives under the framework developed by the Basel Committee on Banking Supervision and the International Organization of Securities Commissions.

T Reg IM requires counterparties to OTC derivatives to post margin on a segregated basis to cover current and potential future exposure during the period between the last margin collection and the time it takes close out derivative positions following the default of the counterparty.

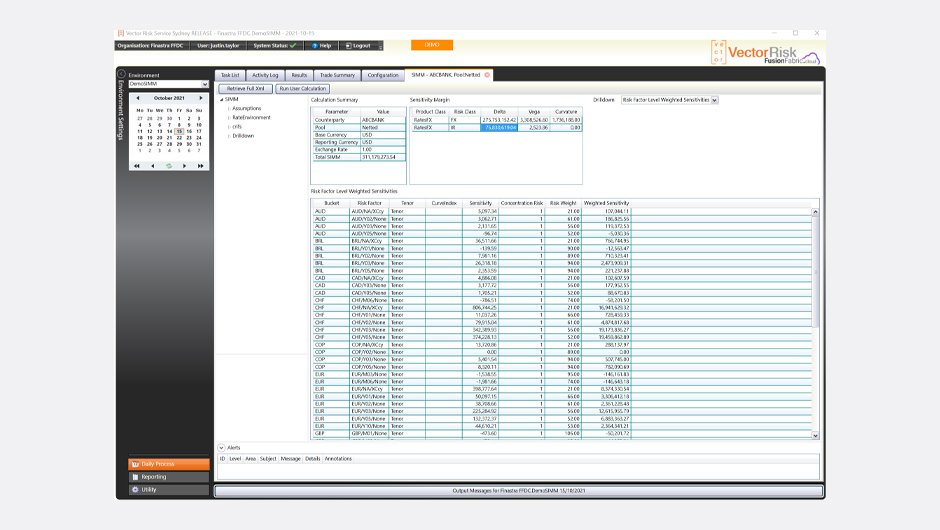

The standardized margin methodology was developed by the International Swaps and Derivatives Association, and is intended to reduce the potential for disputes and create efficiency through netting of exposures. The model applies a sensitivity-based calculation across four product groups: interest rates and foreign exchange, credit, equity, and commodities.

Pre-integrated ISDA SIMM Solution

Vector Risk leverages existing mapping and reconciliation through FusionFabric.cloud instead of the traditional approach of engaging a new vendor and undertaking the process from scratch with all the attendant costs and project risk.

Industry Standard

ISDA SIMM methodology has become the industry standard, and Vector Risk's commitment to regulatory evergreening ensures the solution will always comply with ISDA requirements.

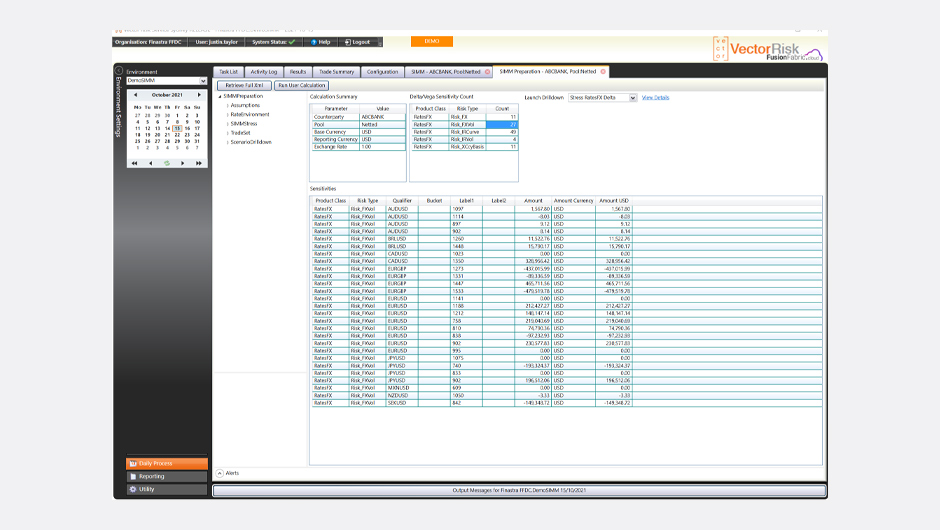

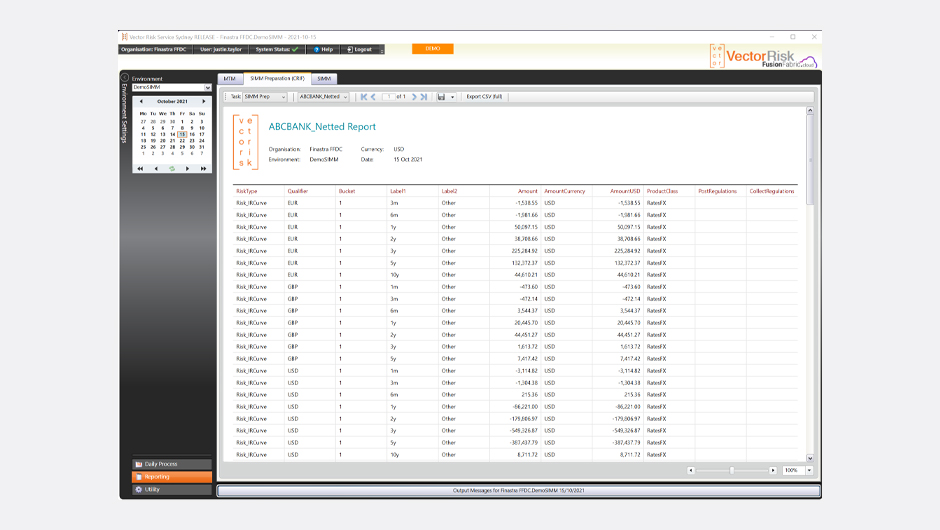

Not a black box

Vector Risk provides a SaaS solution for the bank, not a managed service. Even though the process is automated, the bank remains in control and can drill down into the results to respond to regulatory queries.

Building blocks

Trades Financial Data

Retrieve financial and contractual information of trades, including parties involved, deal type, terms and conditions, with transaction price and the associated market data from the position keeping system

Trades and Positions Data

Get detailed information regarding trades, including historical trends, parties involved, deal type, terms, and transaction price and the associated market data